Aiming (3911.T) is crushing it in the Shadows!

Exec summary

- Aiming, a Japanese video game company, is currently trending with the release of its latest mobile game “The Eminence in Shadow: Master of Garden”

- Game is very popular with fans in Japan, entering the top 10 grossing ranks.

- We believe it will drive significant revenue increase for Aiming, potentially doubling them

- Aiming valuation is relatively low, their profits are increasing and even pay dividend

- Major success like that helps Aiming increase its visibility in the industry, which could help to attract more players to their other games in the future

- We initiated a position into Aiming

The Trend - New game released!

The Eminence in Shadow: Master of Garden is a mobile game that combines elements of strategy, simulation, and role-playing games. The game is set in a fictional world where players take on the role of a young boy who dreams of becoming a hero. The game is designed to be played in short bursts and is perfect for mobile gamers who are looking for a game that they can pick up and play on the go. “The Eminence in Shadow” is a light novel series that has a dedicated following in Japan. By leveraging the popularity of the source material, Aiming was able to generate significant interest in the game and attract a large number of players.

The game could double their revenue!

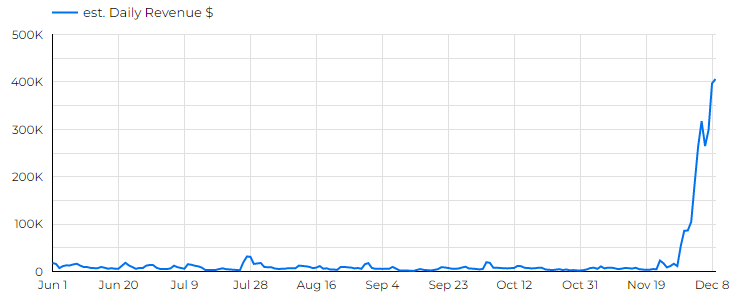

The game’s success is translating into increased revenue for Aiming, with strong in-app purchases monetization. The game seems self-developed and published which means they get the full share of the pie. We estimate its currently ticking approx. US$300k/daily on average, so about US$25-30M quarterly. Their Q3 2022 was a total of US$25M, so it could potentially double their revenue, which is obviously a major impact!

Important note: Most of their current revenue to-date is coming from games published by other companies, with “Dragon Quest Tact” (Square Enix) being the largest until now. Those revenues are not showing in our graph for now, but they are obviously accounted for in last quarter’s US$25 millions revenue.

Some investors are already in, but there is still plenty of room

In November, Aiming stock already appreciated considerably from JPY 300 to above JPY 400. Whilst it is a considerable increase, we believe the success of this game far outshines this hike. Mobile games scale well, and even if they are probably spending a lot on user acquisition, we expect margins to be high on this game.

At current valuation, Aiming’s market cap is approx. US$120 millions, with yearly revenue of approx. US$100 millions, a decent looking balance sheet and now an injection in revenue that will increase their profitability, we think that if they are able to maintain this game at the top, it is a great value stock.

If that was not enough – Aiming tries to reward shareholder by paying an annual dividend. It’s not much, but better than a punch in the face.

Conclusion

We are convinced enough that Aiming enters Active Picks territory. We bought shares at JPY 415 on Dec 5th 2023, and will be keeping it in our close radar in the coming months, at least until the earnings release of February (end of fiscal December).

We’ll post updates if we see anything changing our decision.

GLTA and let us know your thoughts and feedback!

Aiming (3911.T) is crushing it in the Shadows!

Exec summary

- Aiming, a Japanese video game company, is currently trending with the release of its latest mobile game “The Eminence in Shadow: Master of Garden”

- Game is very popular with fans in Japan, entering the top 10 grossing ranks.

- We believe it will drive significant revenue increase for Aiming, potentially doubling them

- Aiming valuation is relatively low, their profits are increasing and even pay dividend

- Major success like that helps Aiming increase its visibility in the industry, which could help to attract more players to their other games in the future

- We initiated a position into Aiming

The Trend - New game released!

The Eminence in Shadow: Master of Garden is a mobile game that combines elements of strategy, simulation, and role-playing games. The game is set in a fictional world where players take on the role of a young boy who dreams of becoming a hero. The game is designed to be played in short bursts and is perfect for mobile gamers who are looking for a game that they can pick up and play on the go. “The Eminence in Shadow” is a light novel series that has a dedicated following in Japan. By leveraging the popularity of the source material, Aiming was able to generate significant interest in the game and attract a large number of players.

The game could double their revenue!

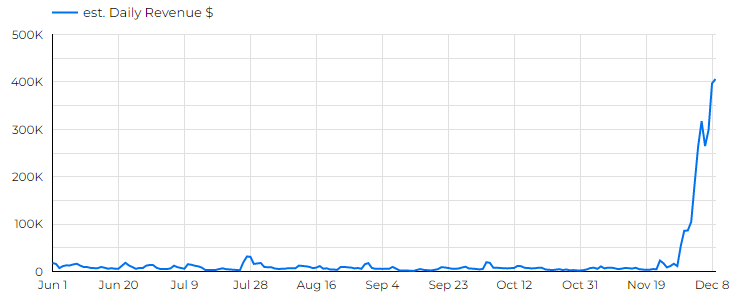

The game’s success is translating into increased revenue for Aiming, with strong in-app purchases monetization. The game seems self-developed and published which means they get the full share of the pie. We estimate its currently ticking approx. US$300k/daily on average, so about US$25-30M quarterly. Their Q3 2022 was a total of US$25M, so it could potentially double their revenue, which is obviously a major impact!

Important note: Most of their current revenue to-date is coming from games published by other companies, with “Dragon Quest Tact” (Square Enix) being the largest until now. Those revenues are not showing in our graph for now, but they are obviously accounted for in last quarter’s US$25 millions revenue.

Some investors are already in, but there is still plenty of room

In November, Aiming stock already appreciated considerably from JPY 300 to above JPY 400. Whilst it is a considerable increase, we believe the success of this game far outshines this hike. Mobile games scale well, and even if they are probably spending a lot on user acquisition, we expect margins to be high on this game.

At current valuation, Aiming’s market cap is approx. US$120 millions, with yearly revenue of approx. US$100 millions, a decent looking balance sheet and now an injection in revenue that will increase their profitability, we think that if they are able to maintain this game at the top, it is a great value stock.

If that was not enough – Aiming tries to reward shareholder by paying an annual dividend. It’s not much, but better than a punch in the face.

Conclusion

We are convinced enough that Aiming enters Active Picks territory. We bought shares at JPY 415 on Dec 5th 2023, and will be keeping it in our close radar in the coming months, at least until the earnings release of February (end of fiscal December).

We’ll post updates if we see anything changing our decision.

GLTA and let us know your thoughts and feedback!