Why we just sold ZenGame now, a triple!

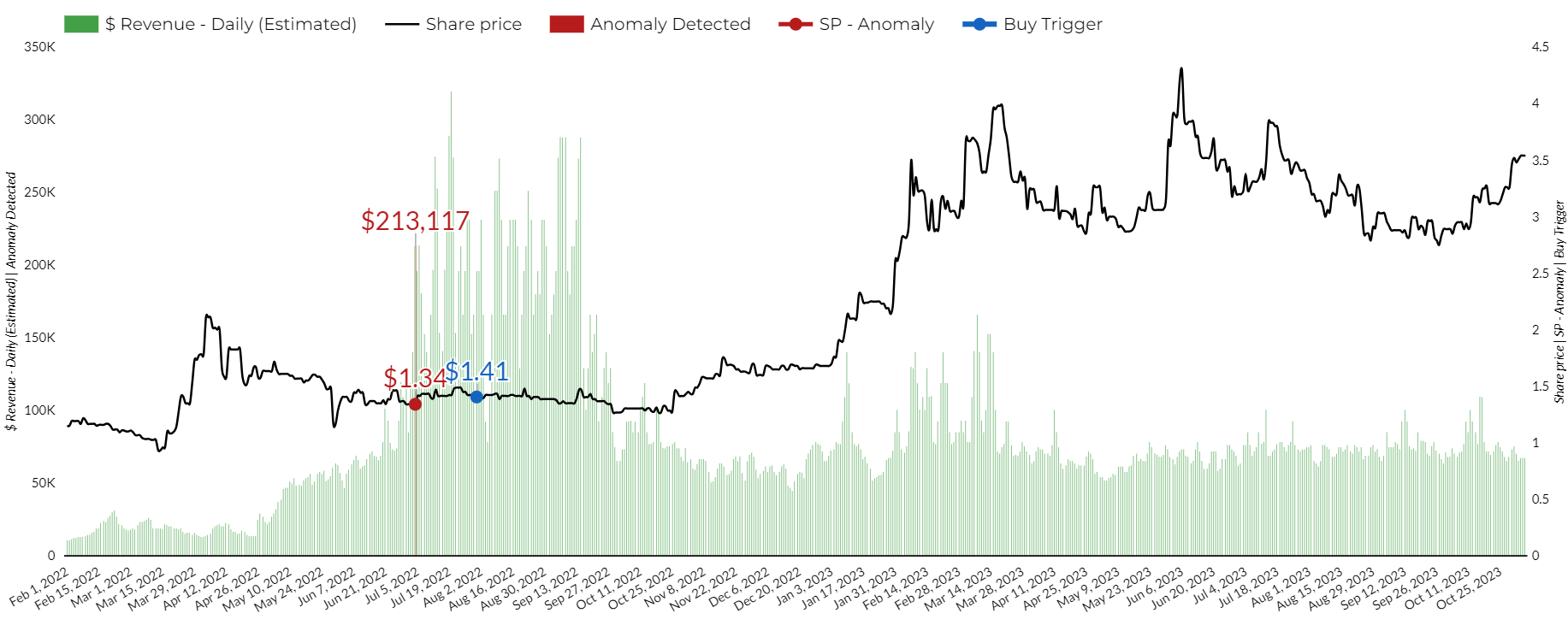

In July 2022 we bought shares of Chinese mobile gaming company ZenGame (2660.HK) (see first article), following the success of their (already-existing) game “Fingertip Sichuan Mahjong” that went unnoticed by the market. After joining our pick list for over a year, we now closed our position this week at HKD 3.75/share and explain why in this article.

Previous ZenGame updates:

Executive Summary

-

On Monday, Zen Game was up 165% since we initiated it at HKD 1.41 in July 2022, beating the nasdaq by 155%. On top of that, we received normal dividend and special dividend worth 25% of our initial share price (HKD0.15 & HKD0.21 a share). A TRIPLE!

-

Whilst its valuation remains low even after tripling, at 1x Sales (TTM) and 2.7x Net Profit (TTM), upside could be minimal from these levels as the company’s growth is stalling

-

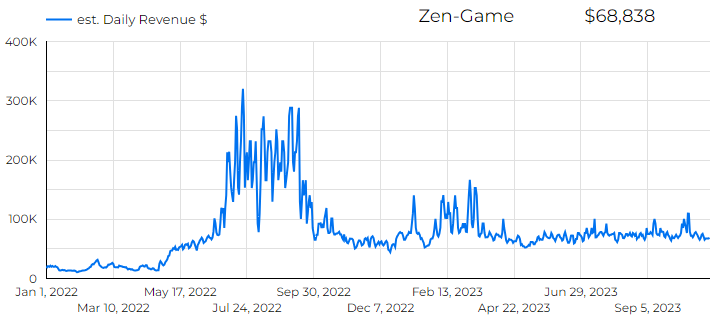

We picked this stock because of a clear catalyst, their Fingertip Sichuan Mahjong game (not even a new release!) becoming more and more popular in China, and no one spotted it.

ZenGame is a poster child for why we built automated tools to monitor app store ranks daily and run algorithms to detect anomalies in patterns. Even without Google Play store ranks in China, using iOS and multiples has worked well for us with ZenGame.

H1 2023 earnings

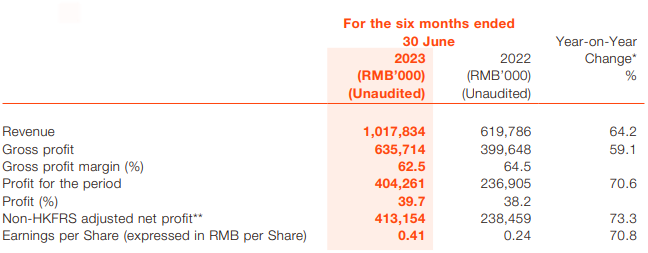

ZenGame announced their H1 2023 (they do not release quarterly but twice a year):

- Revenues of HKD 1,017 millions or approx. US$ 140 millions. This is a 64% increase versus the first half of 2022, but a 11% decrease from H2 2022

- Net profit of US$ 55.5 millions, a 59% increase YoY and -13.8% decrease from H2

- Net Profit Margin slightly increased to 39.7%, as it has been steadily increasing for 3 years now.

Stock, Balance sheet and Valuation

Stock: Appreciating the last quarter

ZenGame’s stock moved up in early 2023 as covered by our other articles. Since then, it has been fairly stable.

Following H1 earnings, investors were not surprised or disappointed by the HoH flat growth from last earnings, which was well received as the stock moved up another 25% from approx. HKD 3 a share earnings to today’s HKD 3.75 a share!

Net profit margin keeps increasing and reaching almost 40% probably helped with that. Those are fantastic margins by the way.

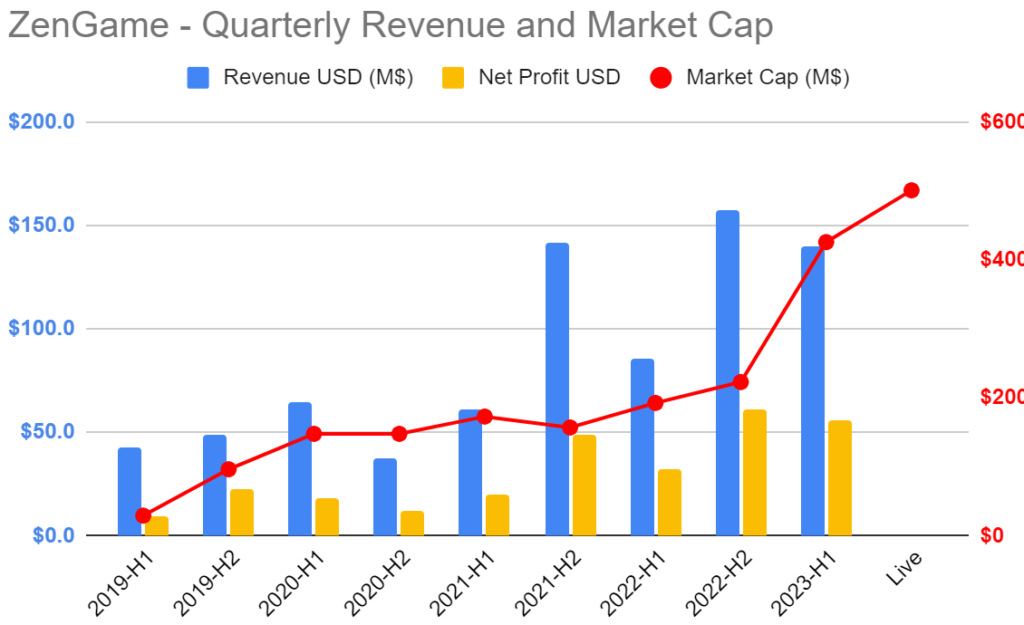

ZenGame’s Market Capitalization grew from US$192 millions at H1 2022 earnings, to almost US$500 millions at the time of writing.

ZenGame valuation remains

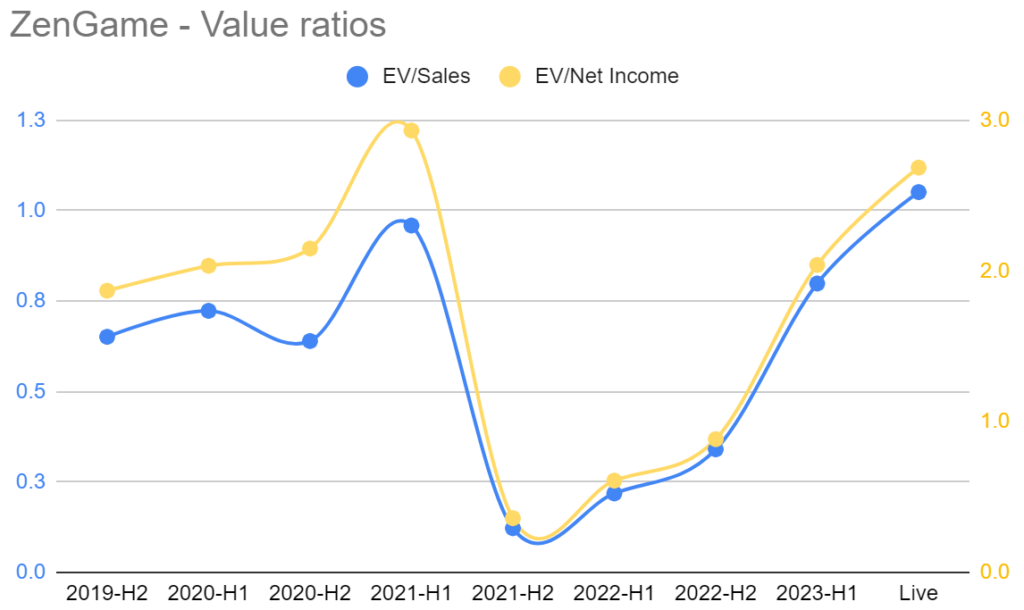

This puts ZenGame’s valuation currently at 1x EV/Sales and 2.7x EV/Net Income (non-adjusted!). These remain extremely low valuation metrics given how profitable the company is, but with no growth in sight, it might just stay there, and that’s why we’re going out, not because of the fundamentals.

As you can see from the graph below, at its lowest, EV/Sales was sitting at 0.12x ! Needless to say, we scooped dirt cheap shares in July 2022.

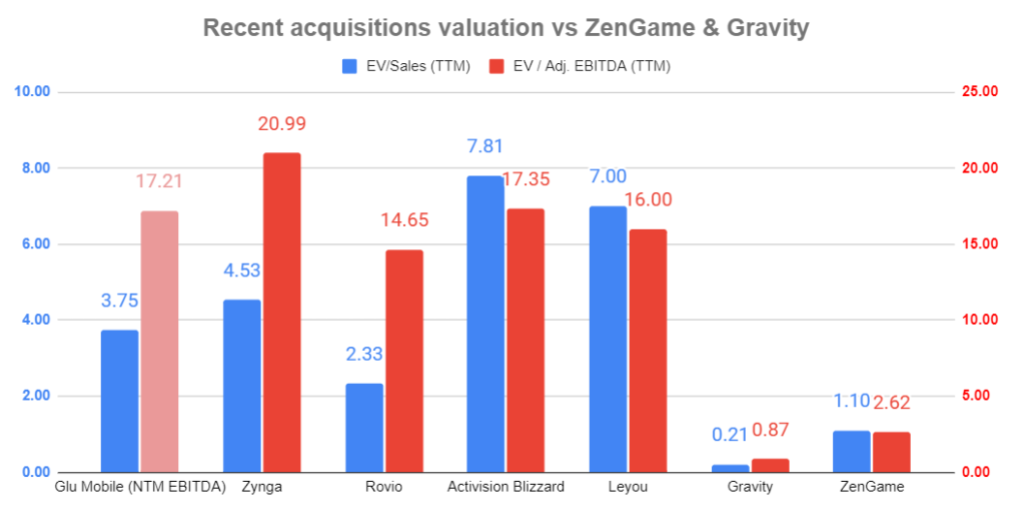

For reference. Leyou was acquired at a 7 EV/Sales ratio by Tencent, Zynga at 4.5 by Take-Two Interactive and Glu Mobile at a 3.75 by Electronics Arts. ZenGame’s valuation remains 3.5 to 7 times lower than these, so it is by no means inflated at this price.

Actually, using the Enterprise Value/Sales TTM metric, only Gravity (NASDAQ:GRVY) has a lower ratio (0.2 !) from companies we follow. Think of it, ZenGame had similar metrics as Gravity when we bought it. The big difference is that they returned shareholder value. Surprise surprise.

ZenGame balancing sheet keep strengthening even with solid dividends

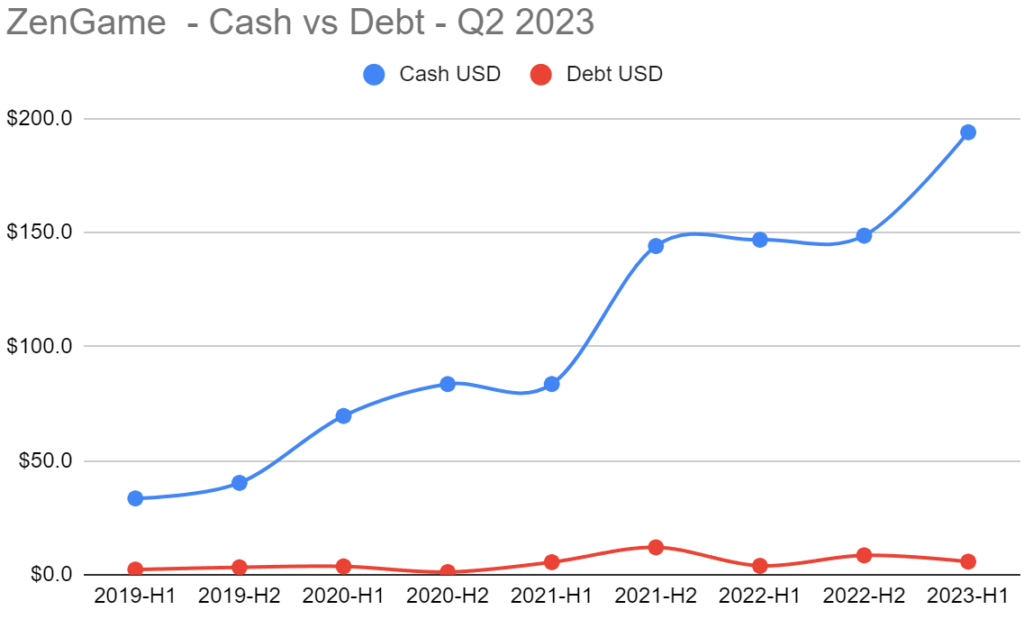

We love cash-rich, no-debt and highly profitable companies. So we love ZenGame. The more we look at their numbers, the more we love them. Cash has been on the steady increase and they now sit on approx US$ 200M worth of it, with virtually no debt.

And they have not been sitting idly on it. With 70% insider ownership, management has been been paying themselves for their good work, with an annual dividend and even a special dividend last year, of HKD 0.21 and HKD 0.15 a share. Since we scooped shares at HKD $1.41, we were pretty happy with that, can you tell ?

Given their profitability margins and business model, that blue line is likely to continue going up, barring an acquisition.

ZenGame's operations show no sign of long-term growth

There is not much to say about the company’s operations. They are very successful in maintaining the interest in Fingertip Sichuan Mahjong with new regular content and strong live operations. These games are cash-cows at this point and they are milking them accordingly.

They have not released any new games that we noticed, and the pipeline is unknown. They mention in their business updates being on the lookout for acquisitions.

The takeaway here is that there’s little hope and expectations for them to deliver the next big hit. They have a successful game, n the largest mobile gaming the market, but potentially no growth coming out of it in the long run, and no catalyst that we can see for a higher valuation

Pros and Cons

Reasons for holding (or buying!)

- At HKD 3.75/share, the company’s valuation ratios are still quite low at EV/Sales (TTM) of 1 and EV/Net Profit (TTM) of 2.7. Compared to other industry players, it remains a decent value play

- At almost 40% net profit margin, ZenGame is an absolute cash-machine and has a very strong balance sheet

- Management is very shareholder friendly with yearly dividends (and even some special dividends). Hardly a surprise with 70% insider ownership.

Reasons for selling

We bought it on the extreme cheap at HKD 1.41/share, converting to an EV below 0.2x Sales TTM. We made considerable gains so it’s time to sell what shares we have left –> Always take profit!

Growth has stalled, and there’s no reason to believe the stock could be another multi-bagger as investors are not willing to give it the valuation it deserves.

Our broker does not allow to keep ZenGame in tax-free registered accounts, so we end up paying taxes on the dividend which makes it a less attractive company to hold.

The company is highly dependent on just one game right now. That is always a risk, even more in a country like China where the government can just close game licenses if they see fit.

Conclusion

The market took a while to react originally, but over 6 months after we highlighted the major increase in their mobile revenue, Zen Game’s good earnings results and willingness to return shareholder value ultimately drove a phenomenal return for us, tripling our initial investment.

That makes it our 2nd best pick in the mobile app market in the last 3 years, close behind Gravity which tripled in 5 months in 2020 (but the tide lifted every game developer through COVID!).

However, the growth story seems to be over for ZenGame and there is no reason to think it will get much higher, even if its valuations remains very reasonable, and their balance sheet is stronger than ever.

We therefore decided to sell our remaining shares and take our gains, but we will keep monitoring their revenues, as a new hit game could easily be a catalyst for this stock. Goodbye ZenGame, and welcome into our closed pick list!

Disclaimer

The information on this website is for educational and informational purposes only and should not be construed as professional investment advice. Please consult with a licensed financial advisor before making any investment decisions based on the information provided on this website. We do not endorse any particular investment product or strategy, and you should make your own decisions based on your own research, risk tolerance, and financial circumstances.