Let’s all sing to Enad Global 7 entrance in our Picks!

Executive Summary

- Enad Global 7 (EG7.ST) is a Stockholm-listed swedish video game company that was founded in 2015 owning a diversified portfolio of gaming brands

- Enad owns multiple studios and publishers, such as Daybreak, Piranha and Big Blue Bubble

- My Singing Monsters, an app by Big Blue Bubble, has been trending recently and has hit the top 30-50 in many major countries incl. US, UK etc.

- Enad 7 valuation is right where we like it to be at US$130 millions, with over US$200m in TTM revenue and a major trending app, it is ripe for a move up

- It logically enters our Active Picks list as of Nov 3rd 2022, at SEK15.33

These songs are music to our ears

This is an unusual story. My Singing Monsters, an app published by Big Blue Bubble, a wholly-owned subsidiary of Enad Global 7, is suddenly trending… and not just in one country. It’s trending worldwide.

What makes it unusual, you ask? Well put simply, this is not a new release by any stretch of the meaning: the game was originally released in.. 2012, over a decade ago!

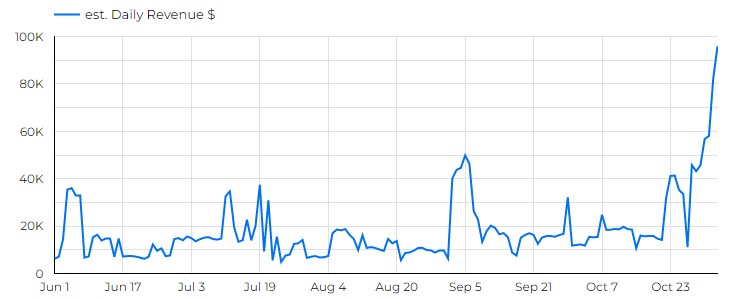

Why does it suddenly trends, hmm ? We honestly do not know at that stage but the increase in revenue is significant and plain to see, and its impact on Enad 7 Global’s financials is noteworthy.

No monsters under the bed, financials are a green light

With this sudden increase in popularity, Enad Global 7’s daily revenue estimates grew from approx. US$15k a day to US$100k a day. And we think our tool is quite conservative when it comes to those top-30/50 games. Take that US$85k increase, multiply it by a full year, and you’ve got a rough estimation. Should they manage to keep this success, Enad Global 7 is looking at US$ 30 millions extra revenue yearly.

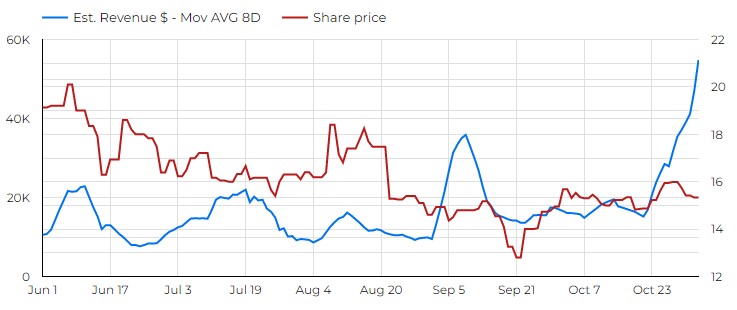

What does that extra 30m mean for Enad 7 ? Well, with 88.6M shares outstanding, you are looking at a US$130M valuation for approx. US$230 revenue TTM. Even if they are not the most profitable gaming company out there, such an influx of revenue is likely tohelp with profitability and impact their stock.

That stock, should we add, has not yet reacted to it, and it might take a while until it does, because to be honest, it’s one of the lowest impact that we decided to act upon.. But the company’s valuation is currently simply too low, so 1+1 = 2, it should add up to some higher margins.

Risks

We are not seeing major flags. Enad Global 7 has all its IR in English and Sweden is a well regulated country and marketplace. Our main concern is what we cannot measure in real-time: the company’s revenue from non-mobile streams. Without a deeper research into their PC & Console business, we have to assume those as basically flat – and focus on what we can see, their mobile revenues. As always, do your own due diligence, and let us know if you see anything.

Conclusion

This uptrend on a decade-long standing game is very encouraging for Big Blue Bubble and by extent, Enad Global 7. That being said, this is not as major an increase as we have seen in recent times, but it seems meaningful enough for us to pull the trigger.

It joins our Active Picks list as of Nov 3rd 2022 and we will update should we see any major changes in our research. GLTA, and do your DD