Feiyu’s Fight Tricks is a catalyst for this stock

Executive Summary

- Feiyu (1022.HK) is a Hong-Kong listed video game company that was founded in 2014 and is based in Beijing, China.

- Marvelous! Is primarily focused on the development and publishing of mobile games

- Release of version 1.4 of “斗诡” (translates to “Fight Tricks”) drove major increase in app downloads and revenue and the game became a top 50 ranked game in China

- Feiyu enters our Active Picks list as of May 16th 2022, at HK$ 0.32

Fight Tricks to the rescue

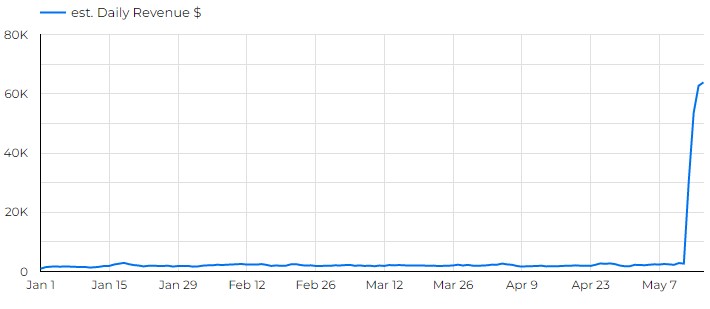

Fight Tricks (斗诡 in original language) is a 2D action RPG (see gameplay video) released in 2021. The recent 1.4 update seems to have been a major success, allowing the game to reach its highest grossing ever as shown in the screenshot.

We have learnt in the past to not jump in too quickly when it’s an update rather than a new release that triggers such a massive injection of cash – but this is different. It’s not a game that was hugely popular and that releases a new expansion/update every 6 months, and gets some new juice. We think the popularity of this game is simply rising and here to stay.

Financials and impact of this game

With this sudden increase in popularity of the Fight Tricks game, the dormant Feiyu awoke from the dead and saw its revenue move from US$2k to US$60k. That’s only on iOS – given the success is in China, we do not know the impact on android because google play does not exist there.

We like to be conservative with our estimates, so let’s assume a US$20K long-term for iOS, and triple that for the huge android market, at US$60K, giving us a rough estimate of US$80K/day extra revenue. It’s super rough, we won’t deny it. That would translate to approx. US$30M in a full years’ revenue.

What does that mean for our flying fish ? (it seems that’s what Feiyu translates into).

With a fiscal year 2021 revenue of approx. US$15M, this game has the potential to more than double their revenue, and we like that very much, oh yes we do.

What we do not like as much, is the fact that its market cap brings its valuation to US$70M (HK$550M). It’s not a crazy high valuation, mind us, but it certainly is not as attractive as some of our other picks with a much lower EV to revenue or even income ratios. That being said, an extra US$30M in revenue has the potential to drive this stock through the roof in the long run.

Feiyu is a riskier investment, as it was not profitable for years

Every investment has risks and Feiyu is certainly no exception. It is a small cap, Chinese company, and most of all, it has seriously struggled with profitability over the past few years, since 2016. That being said, its cash still exceeds its long-term debt, they still have a good runway. Another risk worth highlighting, is that we never know how much spending in user acquisition they are doing. Growing revenue is great, but it always depends at what cost. Whilst development costs are usually fairly linear, user acquisition and other advertising could grow significantly.

Overall, we still think it well worth the risk – albeit with a smaller position. A turnaround to profitability could move the stock to new highs.

Conclusion

This is one of our riskiest investment to date, after GameOne maybe. With doubled revenue on the line, the catalyst is significant, but will it be enough to get them to profitability ? We believe so, and we initiated a position. Feiyu joins our Active Picks list as of May 16th. Go to our picks tracker to see the continuously updated graph showing revenue and stock price.

GLTA!