Gravity Q2'2023 updates - pre-earnings

Gravity joined our Picks in October 2022 (see initiation article), highlighting their strong operational performance combined with a then low valuation (we bought at $46). Q2 ended June 30th for Gravity and a lot happened these past 3 months, so let’s dive in and discuss what to expect in their earnings release on August 9, and beyond. For a refresher, beyond our initiation we we covered Gravity operations in the past here:

- Gravity – 2022-Q4 earnings summary

- Gravity – 2023-Q1 pre-earnings article

- Gravity – 2023-Q1 earnings summary

Executive Summary

- Following a strong Q4’22 and Q1’23, Gravity (Nasdaq:GRVY) has seen its stock outperforming the market with a booming +100% YTD, against +35% for the Nasdaq

- Q2 looks like another revenue and profitability record quarter given how massively successful their Ragnarok Origin (ROO) release in remaining SEA countries has been

- There is noticeably more noise around Gravity on social media in the recent weeks, which has brought visibility on their low valuation to a larger amount of retail investors

- Whilst there are a few clouds that we will be monitoring, between poor cash allocation, unproven games pipeline and retail investors bringing high volatility, we are keeping our shares of Gravity as we believe it remains undervalued

Q2 2023 Highlights

Let’s dig into Q2, first into the game operations and subsequently at how the stock has fared.

Operations: Phenomenal Q2 with ROO beyond all expectations

Operationally-wise, Q2 started off incredibly strong, with the very successful early-April release of ROO in SEA countries (Philippines, Thailand, Indonesia, etc.). The game boasted 10 millions pre-registered users, which is just a staggering number for any worldwide game release, which is a testament to the rebirth and rise of the Ragnarok IP in Asia in recent years, led by their mobile games (Eternal Love, Origin and Next-Generation).

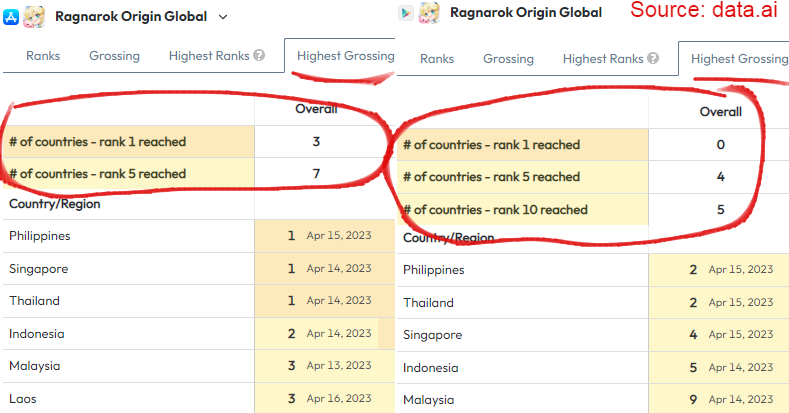

So it came as no surprise that the game hit the top 1-3 grossing (higher in-app revenue generation) rank in every country it got released on both iOS and Google play, and that over the course of Q2, it consistently remained in the top 5. The game being cross-platform, you can almost certainly expect the same level of success on PC, where the transactions are higher margin given Apple & Google are not getting their cut.

Operations: What of other games ?

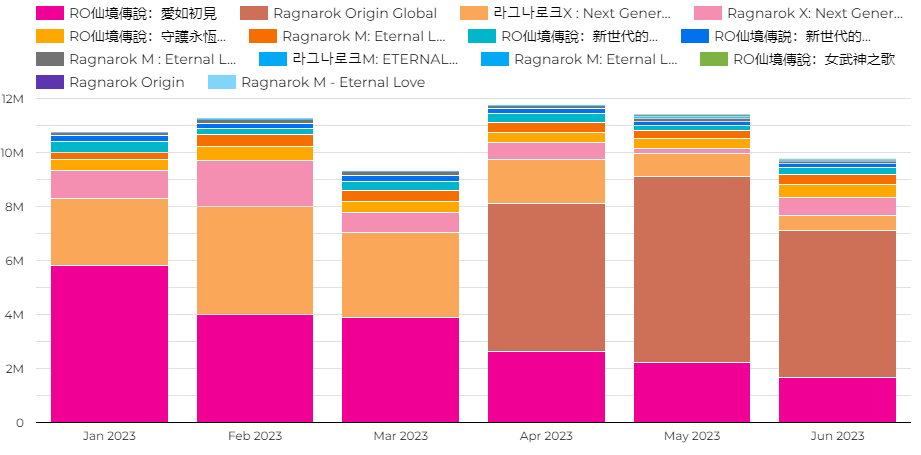

Looking at other games/releases (we kept only the top games in our chart), we can naturally expect less revenue from ROO Taiwan (released in October’22) and ROX Korea (released in January’23) which drove Q1 record-beat.

So the question is: is ROO SEA covering for that? We believe it does, and we expect Q2 to be another record-breaking quarter, both in revenue and profitability.

Other updates:

- Ragnarok Next Gen in SEA (pink) is showing resilience after the ROO launch

- Eternal Love M (in orange) is at cruise-speed a usual

Note: Those numbers are coming from a proprietary tool that uses daily grossing ranks in 40+ countries to estimate each mobile’s app revenue. They do not reflect actual revenue, but are directionally useful. If you want to know more about our methodology that helps us finding our picks, it’s right here.

The successful release of WITH: Wale in the High (achieved top 10 downloads in Japan, the 3rd largest mobile market) is also an encouraging sign for Gravity’s “spaghetti throwing at the wall” strategy of publishing high potential games from indie studios. We do not expect meaningful revenue in Q2 for this game.

Q2 review: what about the stock ?

All those operational successes seem to finally have been paying off for Gravity’s shareholders. To our delight, the stock is up a whooping 47% since pre-earnings to $81, against $55 pre-earnings. This means Gravity is now up 75% since our initiation article, a pretty solid return in 9 months.

This puts Gravity at a US $565M market cap for an approx. EV of US $275M when factoring in their cash position. We expect Net Profit in 2023 to be beyond US $100M, so the stock is still trading at below 3x yearly Net Profit, a good deal in our books.

Whilst this increase in valuation can most certainly be correlated to their stellar results in Q4’22 and Q1’23, as well as the high expectations for Q2, we would be remiss not to mention another phenomenon that could help explain the most recent hike in the stock price: social media.

Indeed, just in the last month only (15th June to 15th July), Gravity is up 26%, now trading at 565M market cap. In that period, the handles on social media, with Twitter leading the charge, have shown a lot more activity than it used to. We noticed a few “finfluencers” or “fintwits” as they’re being named, calling out Gravity’s outrageously low valuation and PE against its peers. Our favorite article was written by Clark Square Capital, who paints a clear, historical picture of the company and suggests at price target of $190.

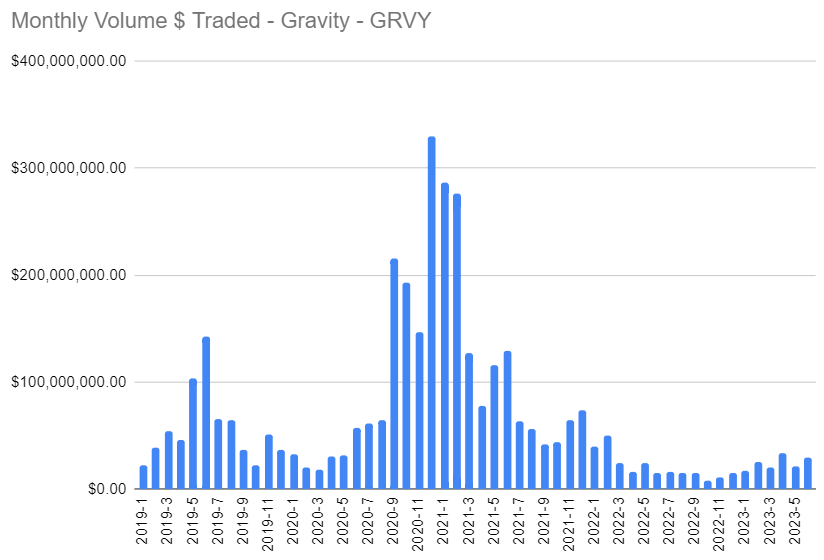

Given GRVY’s low float (59% of shares are owned by Gungho, remember?), buying pressure rapidly drives the stock up. A rapid glance at the volume of $ traded against 2020 and even 2019 shows however that we cannot call it a hype just yet, but it certainly is picking up from 2022.

Negatives - what we'll keep in check

We love that Gravity is executing well and that they are getting rewarded for it, but there are always risks to any investment. Let’s update on those.

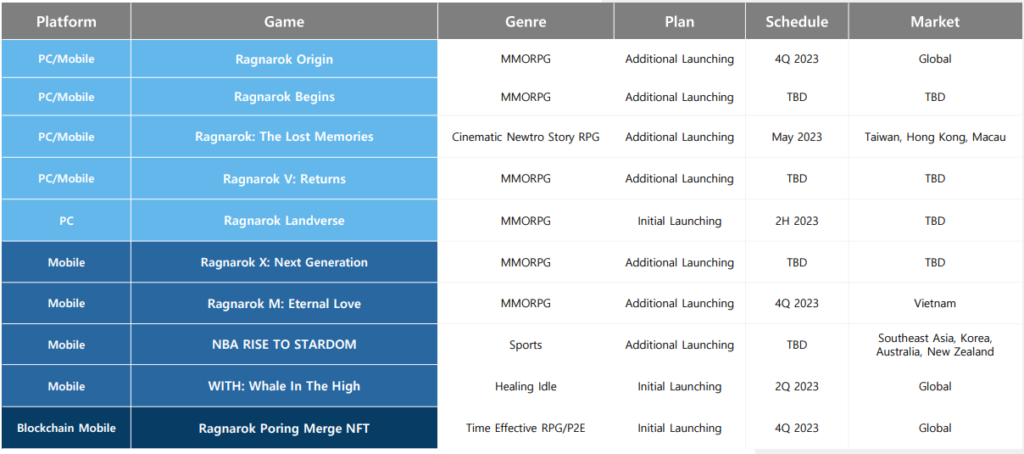

2H 2023 game pipeline looks weak

Investors are expecting Gravity to keep on their growth trajectory. With both Origin and Next Generation at the end of their release cycle, we can expect their revenue to slowly decrease, even with good Live Ops. So far, they have shown an ability to keep games for multiple years in the top 50, but not in the top 5.

What this means is that, like any other game developer and publisher, they need to get new games out to keep their growth going. With the Ragnarok IP getting more and more traction, we are confident that they will have other successes, but is any game in the current pipeline the next A game?

Ragnarok Begins and Ragnarok V: Returns seem to be the highest budget games, and have been launched in ‘beta regions’ for Gravity without much noise. Ragnarok Landverse, a PC low-budget revamp of Ragnarok Online in which they integrated a Play-to-Earn NFT approach is unlikely to be a game-changer. Of course, Ragnarok Origin still needs to be released in countries in which Ragnarok IP is less known (aside from maybe Brazil in which it’s bound to be a success!). All in all, it’s not clear which will be the next hit.

Retail investors: What comes around goes around

For all the visibility Gravity is currently enjoying (and it remains relatively small-scale), retail investors have a tendency to jump from hype to hype. They like Gravity now because its stock is going up. Some expect huge Q2 earnings and are here to ride it. What happens the minute they disappoint? They all flee like rats deserting a sinking ship. Remember 2020 bonanza and 2021 descent to hell ? Here’s a visual reminder.

Ragnarok Origin SEA revenues are hard to predict (and that could go both ways)

There is an expectation of huge earnings in Q2, given how ridiculously popular Ragnarok Origin is. But we need to keep two things in mind:

- SEA release targets mostly lower income countries, much more so than Korea, Taiwan and Japan in which the game was already released. We’ll only know at earnings what these top spots really mean for these countries. Sites like SensorTower are very approximate at best. Largest beat or disappointing Q2? We believe it’s the first, but are not 100% convinced.

- There is a chance its success has cannibalized other Ragnarok games revenues, in particular Ragnarok Online (RO).

RO is the OG, a MMORPG released in 2002 that they somehow managed to keep growing to US$60 millions in revenue per year even after 20 years

Cash hoarding… forever?

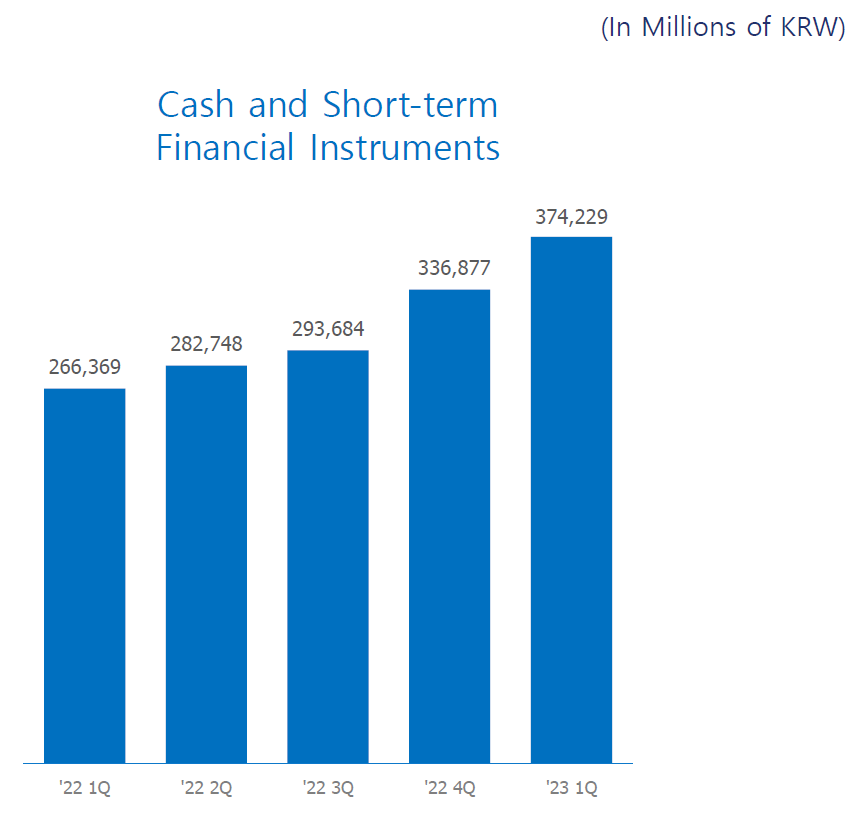

As of the end of Q1, Gravity had accumulated US $287M in cash and is expected to generate another US $80M in profit in Q2 at least. We like to see them trying to invest in new franchises and indie games such as WITH – Whale in the High, but we would like to see more daring projects such as strategic studio acquisitions. That may be what they are looking at by publishing games from indie studios, it’s an approach companies like Glu Mobile (now part of Electronic Arts) was successful at.

Otherwise, we would not mind a dividend or some buyback to return values to their shareholders.

Conclusion

Gravity is executing extremely well and getting noticed for it. With no debt and a growing mountain of cash, the company has an EV of US $275M (at $81.20 a share). Assuming a yearly net profit of US $100M, they are trading at just 2.75x yearly profit which remains very interesting.

There are a few yellow flags looking at the 2024 horizon, so we will keep monitoring how their existing and upcoming games are ranking on a daily basis as usual.

Meanwhile, we’re in it for the ride and with all the positive build up, we are quite happy with holding our shares and are not selling our +75% profit just yet.

As usual, do your research, ask your questions and GLTA!

Disclaimer

The information on this website is for educational and informational purposes only and should not be construed as professional investment advice. Please consult with a licensed financial advisor before making any investment decisions based on the information provided on this website. We do not endorse any particular investment product or strategy, and you should make your own decisions based on your own research, risk tolerance, and financial circumstances.