GREE is in Heaven, and it’s not burning red

Executive Summary

- GREE (3632.T) is a Japanese video game company founded in 2004 and listed on the Tokyo exchange, with offices in Tokyo, San Francisco, Beijing and Seoul

- Known for titles such as DragonSoul, Knights & Dragons, and War of Nations, it is a major industry player in Japan

- Through their subsidiary WFS, they have released Heavens Burn Red on February 10th 2022, and the game became an instant hit

- With a fair valuation, good balance sheet and a major increase in revenue, GREE enters our Active Picks list as of February 13th, 2022

Heavens Burn Red - straight to the top

WFS, a fully-owned subsidiary of GREE, has just released Heaven Burns Red (ヘブンバーンズレッド in original Japanese), a free-to-play mobile game co-developed with Key.

The turn-based roleplaying game takes place in a world where the Earth is being attacked by mysterious extraterrestrial life forms called “Cancer.”, that are immune to any kind of weapon and have been forcing humanity to abandon most of the Earth’s surface. Enters you, the player!

It came out on February 10th on both iOS and Android and shot straight into the top 3 grossing charts in Japan. It also took the #1 spot for download in the country. The game is or will be also available for Windows on Steam.

Financials are lookin' sturdy

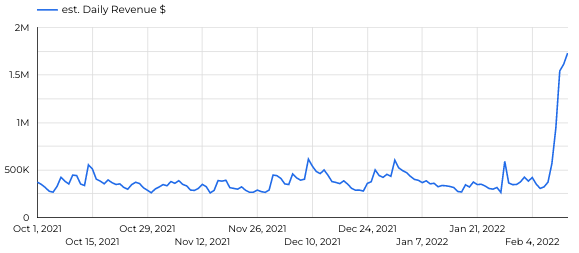

We estimate the revenue generated by this new game of US$1 million daily. This increases from US$500K to US$1.5M the revenue we were estimating for GREE!

Conservatively, if they keep it up, this could generate over $US400-500 millions revenue in a year. That compares against an approx. US$600M revenue generated in the last twelve months.

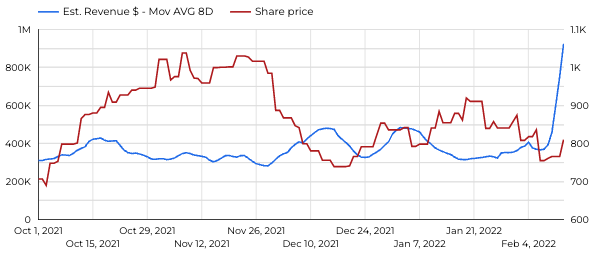

It is fairly easy to see how this could have a major impact for the stock. To top that, at JPY 810 a share, the company is valued at approx. US$1.1 billion with a PE below 10, which we find to be extremely fair for a company the size that size and profitable.

The market has not reacted just yet – and the stock had even fallen down from it’s November’21 highs of JPY 1000s to JPY 800, as you can see on the right in red, against the 8-days moving average of our estimated revenue plotted in blue.

As usual, we believe a success like that helps solidify their player base and could pay dividends in the long run too.

Risks

There are always risks to investing in a company, even more when it’s in a language you do not comprehend. Google translating their reports is fairly easy but can lead to missing specific points.

Another aspect is that GREE is not just a mobile game company, they also produce video games and they also have a venture arm, investing in startups and other game developers. We have very little ways of knowing how those businesses are doing, but we think this is highly mitigated by how impactful this release is for them.

Conclusion

GREE is a major player in the field in Japan, and we expect to see hit games from such a company once in a while. Yet, by looking at all the metrics, we think the risk/reward is looking very strong and have initiated a position in GREE on the Tokyo exchange.

It joins our Active Picks list as of February 13th, 2022 and we will update should we see any major changes in our research. GLTA!