Most investors look at two key aspects of a company:

Every day, new apps are being developed and published on the app stores. It is a huge $200B market, yet you only hear about a dozen of them.

With a pie so big, many under-the-radar publishers are raking millions in profits year after year. Some are public, some are private.

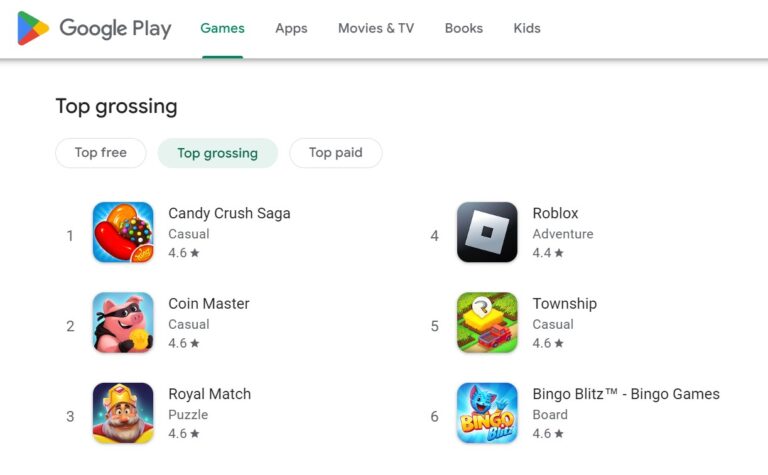

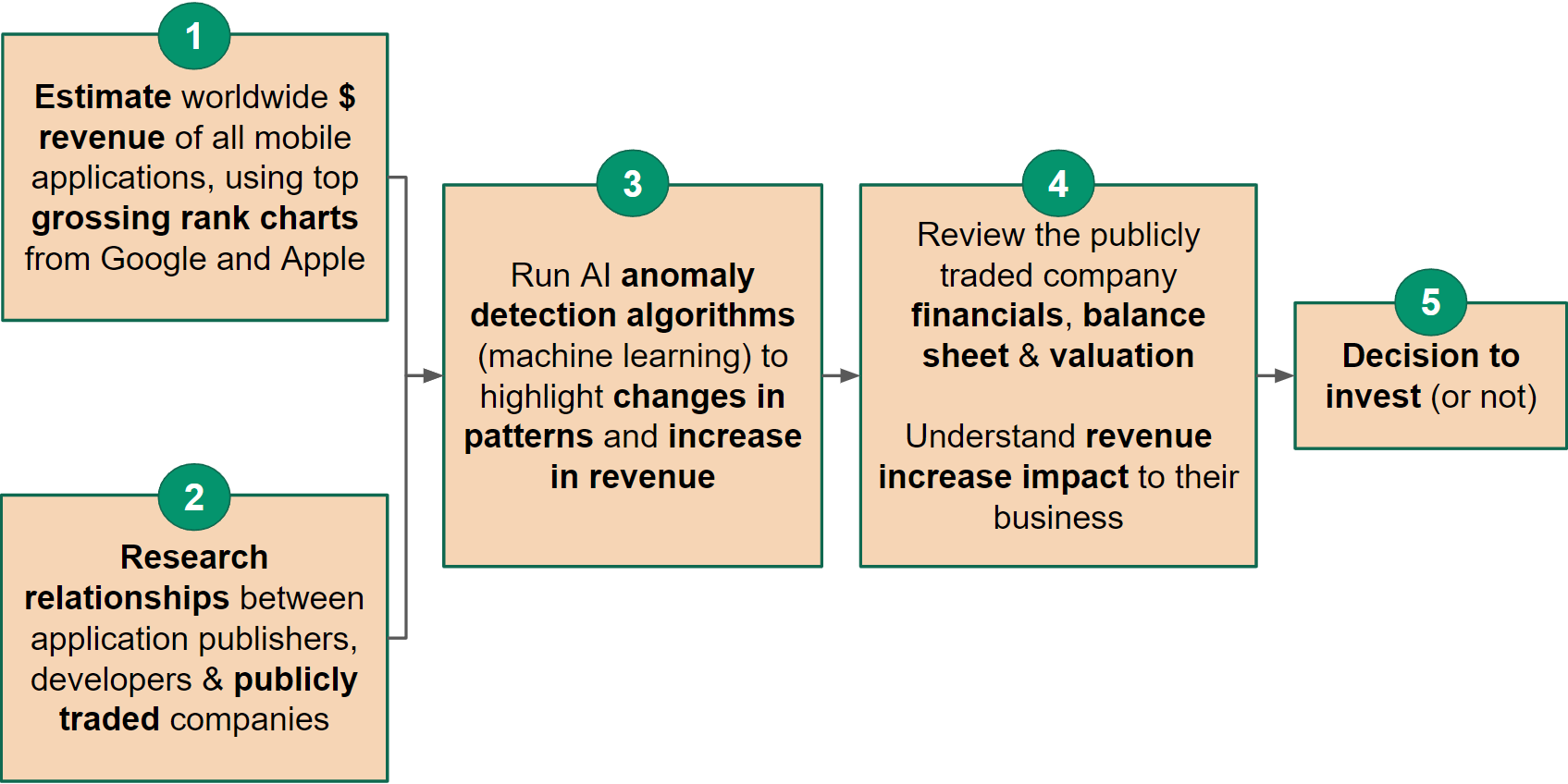

Here is why you should care: Google and Apple have been, for over a decade providing for free their rankings (see image) of the most downloaded and top grossing apps (in-app purchases), by country.

You read that right: the 2 largest app marketplaces have been telling the world which mobile apps are generating the most revenues.

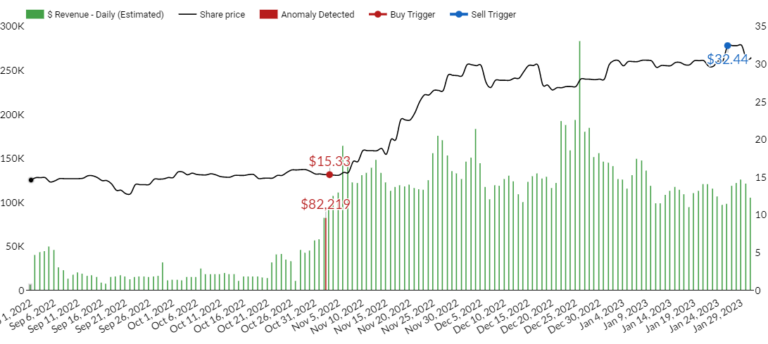

If you can crunch that data, you can predict how well these companies are doing. That’s what we do.

Over the past few years, we have developed bespoke tools to:

From now on, we will be sharing findings to anyone who follows us on our Blog.

Over the years, we have logged over 5000+ publishers and mapped them to 300+ publicly listed companies, ranging from $5M to 2$T in market capitalization. Our algorithm follow them all, from Playtika to AppLovin, from SciPlay to Electronic Arts.

It is a notoriously difficult market to penetrate (some apps are sitting in the top 10 for years now!) and a patient game for investors to play. To top that, many successful Apps are published by private companies, in which we cannot easily invest.

To sum it up: Occurrences are few, but rewards are high. That is because we have the early-mover advantage. We spot major changes in revenue patterns on the day, and research whether that change is significant enough to move the stock price.

That’s what App Investing is all about. Be ahead of the pack, follow us.

There is no fail-proof way to invest in the stock market, no silver bullet. What we are good at, is estimating revenue. Sometimes the market does not reward successful companies. Sometimes, we make a mistake. But look at the track record, understand the methodology and make your own mind about it. We’ve been investing in mobile publishers since 2013 for a reason.

There are already serious incumbents selling professional services at a high price tag, mostly to institutional investors. We are doing the research anyways, and do not see any harm in sharing it. On the contrary, we are hoping to get feedback and improve it. If we see significant interest, we might monetize it in the future.

Two reasons we can see:

Retail investors are more nimble: you do not need approvals to invest, you can be quick. Also, you can invest in smaller companies without outright impacting their stocks!

There are multiple brokers allowing you to trade overseas, wherever you are. We have been using Interactive Brokers for over a decade now, both whilst living in Europe and in North America. As far as we can see, it remains the cheapest and easiest broker to buy stocks internationally.

There are always risks investing in stocks, and sometimes fees, whether locally or abroad. Hong Kong, Japan and Europe all have very reputable market places, just as the US and Canada do. Research those exchanges and understand their terms.

Our role is not to advise on where to put your money, we are simply sharing research. Read up on the company and do your own due diligence before investing. For ourselves, we believe in spreading our capital across industries and only allocate a portion of our own portfolio into the App stocks.

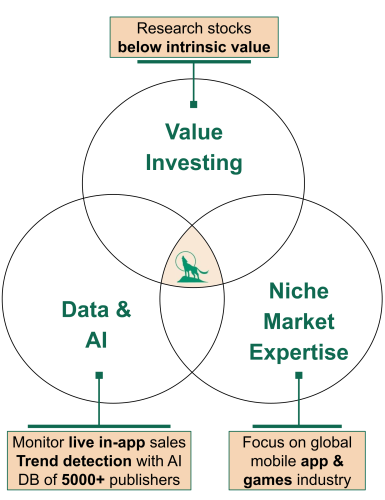

Value investing is a long-term investment approach where the investor seeks out stocks that are believed to be undervalued in the market, with the goal of realizing capital appreciation over time as the market corrects. This approach focuses on finding companies with strong fundamentals and a history of stable financial performance.