Qingci Games, a solid mobile gaming company with ignored catalysts

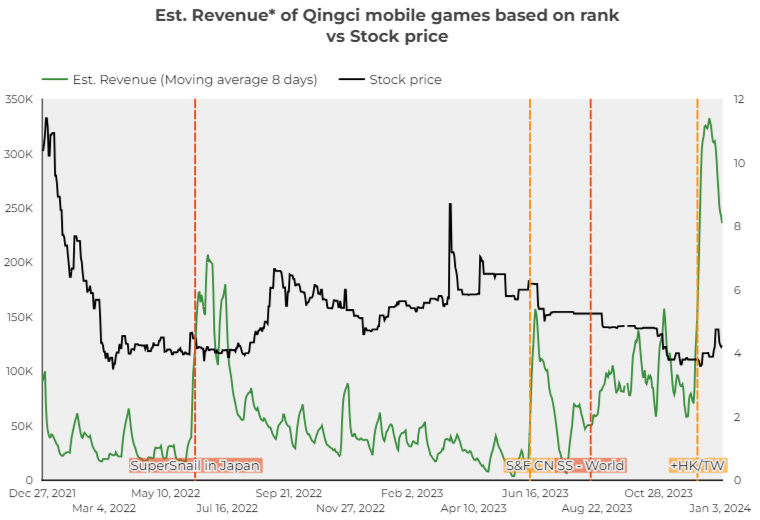

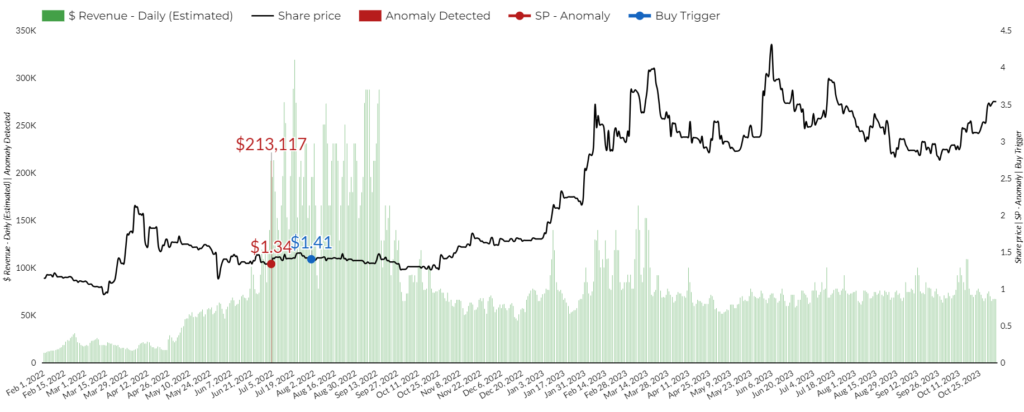

This is an initiation article for Qingci (6633.HK) a mobile gaming company from China traded in Hong Kong. In this article, we cover why, using our proprietary algorithm to estimate revenue in mobile apps, we decided to buy shares from Qingci earlier last month and have it join our picks.

We’ll look at the company’s operations, its balance sheet and valuation and finally dive into the major catalysts in H2 2023 convincing us their upcoming earnings release is about to be a blowout.

Executive Summary

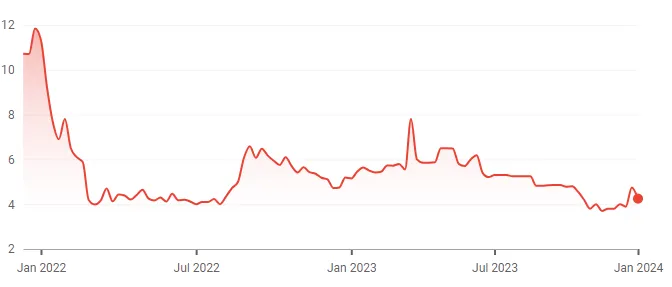

- Qingci is a chinese mobile app publisherwhose growth has stalled following their December 2021 IPO, at the peak of their flagship SuperSnail game, with its stocks trading today at round 40% of IPO value

- Three positive catalysts happened in H2 2023, with the successful worldwide expansion of SuperSnail, combined two new successful card collection games, one male and one female oriented

- We estimate H2 2023 will beat H1 by at least a 50% increase in revenue compared to H1, whilst the stock is sitting close to all-time low

- With a strong balance sheet and cash chest worth half of its market cap, and revenue about to blow up, we believe Qingci has the potential for a swing trade and is one of our favorite pick going into 2024

By joining our pick list, Qingci now has its dedicated data sheet page on our website. We also welcome all questions and conversations on our substack and Twitter.

The article is covering the topic in 4 main chapters:

-

-

-

Company Brief

-

The Turnaround Story (Operations)

-

Stocks, Financials & Valuation

-

Concluding thoughts – Pros and Cons

-

-

Want to know more? Let’s dig in!

Company Brief

Qingci Games Inc. (sometimes referred to as QCPlay Limited, or Xiamen Celadon Digital Technology Co, Ltd for its non-romanticized name) is a mobile video game maker from Xiamen in China. Qingci has traded on the Hong Kong exchange under 6633.HK since its untimely IPO in December 2021 at HK$11.20 a share, which was subscribed by Boyu Capital Group and Qookka (owned by Alibaba) and Tencent was among the investors.

As with other Hong Kong traded companies, it reports on a half-a-year basis rather than quarterly, so that’s why you’ll see numbers of “H1”, “H2” rather than the usual Q1 to Q4.

Business model: Qingci develop games in house as well as publish games in-license in China and the rest of the world. As of June 2023, In-house games make up for roughly 70% of their revenue, vs 85% a year before.

Qingci's revenue drivers

Their most successful game before 2023 was “SuperSnail”, sometimes also called “The Strongest Snail” or “Marvelous Snail”. Officially launched in June 2020 in Mainland China, it hit the top 3 grossing rank. By the end of July, the craze came to Hong Kong and Taiwan where it hit the top spot. At that time, Qingci was still a private company.

SuperSnail is an ‘idle’ game (you don’t have to spend a lot of day on it) that feels like a sitcom in the form of a game, where players control a snail who wants to become the most powerful existence. It’s easy, really funny, geeky. You can see some of its gameplay.

With strong retention, the game still has a trail (ho ho ho) of users after 3+ years of activity. It has generated over US$ 400 millions in revenue for Qingci. In H1 2023, it still generated almost US$ 30 millions. Ultra-slow-but-steady wins the race?

Other active games, by order of forward revenue-generation:

“New Legend of Sword and Fairy”, a story card-based mobile game jointly released on June 9th 2023 with China Mobile Games. It is based on the Sword and Fairy universe and is now also released in Taiwan and Hong Kong with great success. More on this later.

CardCaptor Sakura, release this fall in CN, HK and TW. More on this later.

“The Demonic Plan” – a strategy card battle game developed in-house and launched in January 2023. In its first recorded period (H1 2023), it recorded RMB 27.8 millions in revenue (US$ 3.9 millions).

“Lantern and Dungeon”, a rogue-like RPG launched in March 2021, still generating RMB 8.3 millions (US$ 1.2 millions) in H1 2023. They have plans to launch a remastered version in HK and TW soon which is great news

There are 4 other games contributing to top and bottom line, but the mentioned ones account for the bulk of Qingci’s revenue.

The Turnaround Story

Qingci disappointing 2022 & early 2023

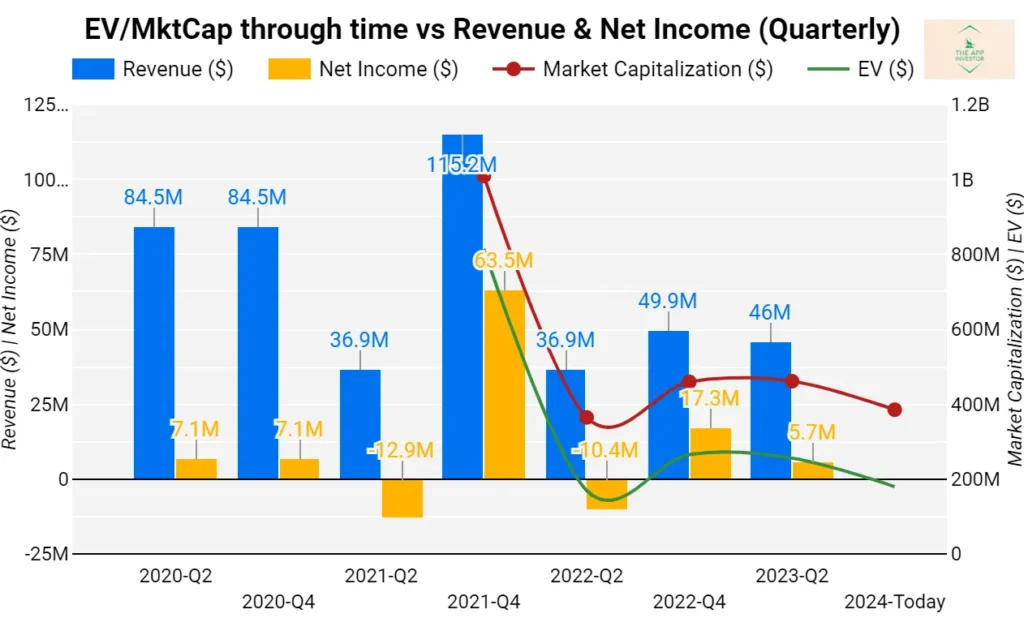

In 2022, Qingci recorded US$ 88M in revenue with only US$ 7M in net profits. In H1 2023, Qingci’s revenues came in at US$ 47M with an aftertax income of approx. US$ 6M.

Compare it to past years:

2021 with US$ 155 M in revenue and EBITDA of almost US$ 60M

2020 with US$ 172M in revenue and EBITDA of US$ 23M

And it’s easy to see that revenue has been declining, with SuperSnail slowly but surely loosing steam like any game does… or is it ?

This has not impressed investors, with Qingci trading at around US$ 385M as of last earnings (H1 2023), against a valuation of over US$ 1 billions at IPO.

But we believe this is about to change drastically starting from H2 2023, as we will now cover in detail.

Catalyst #1 - Release of The New Legend of Sword and Fairy

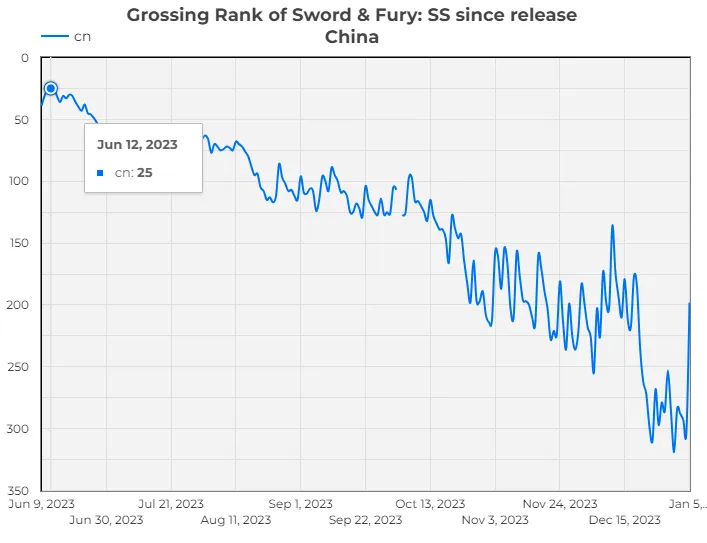

The game “New Legend of Sword and Fairy: Swinging the Sword to Ask for Love” (annnnd breathe! Let’s call it S&F:SS for short going forward, yes?) was released in China by Qingci in June 2023.

The game has enjoyed considerable success since launch, hitting top 15 grossing rank in China and generating RMB 68.3 millions (close to US$ 10M) in just the 20 days of June 2023 alone, based on their H1 report. Get a glimpse of the gameplay here if you’re curious..

Looking at app rankings, our brand and butter after all, it’s clear they were not able to maintain such a high grossing rank in the long run. It stabilized in the top 50 range in June, Top 100 by August. 6 months in, it’s staying in the top 150-250, adding a new constant stream of revenue for Qingci in their home soil.

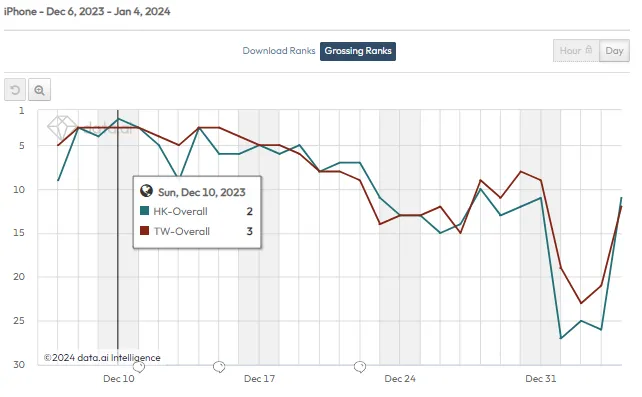

But then December came along, and S&F:SS was further released on Dec 9th in Taiwan and Hong Kong, published by SuperNova, a subsidiary of China Mobile Games & Entertainment (CMGE, HK:0302). And what a hit that is! Top 3 at launch, the game is, a month later, still in the top 15 on both apple and android stores.

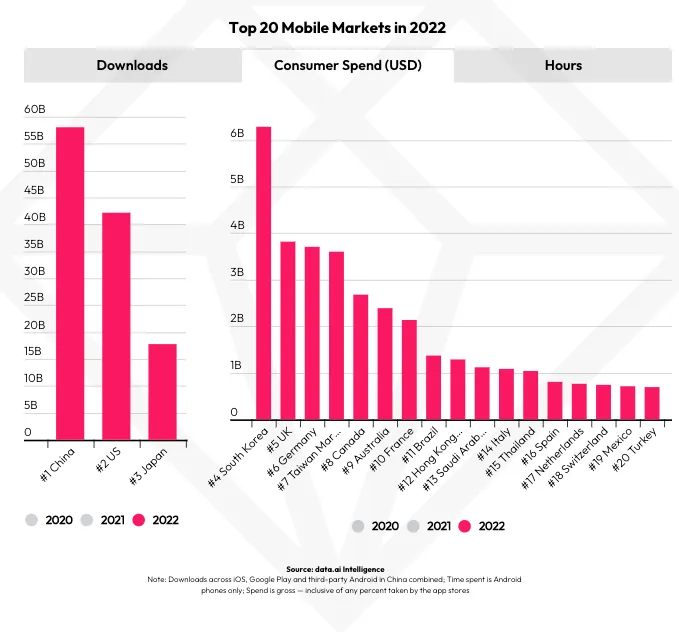

For those not familiar with mobile app market sizes, Hong Kong and Taiwan, in particular Taiwan, are large countries when it comes to in-app spending. Actually, Taiwan is ranked #7 in the world, fighting for the UK and Germany for position.

So this translates into considerable revenue and we believe this is currently the largest money-maker.

All in all, we think S&F:SS has contributed to a new revenue stream of approx. $25-35 M in H2 2023 alone, and will be complementing SuperSnail as one of their main revenue drivers for H1 2024 too.

Sounds good? Well it gets even better!

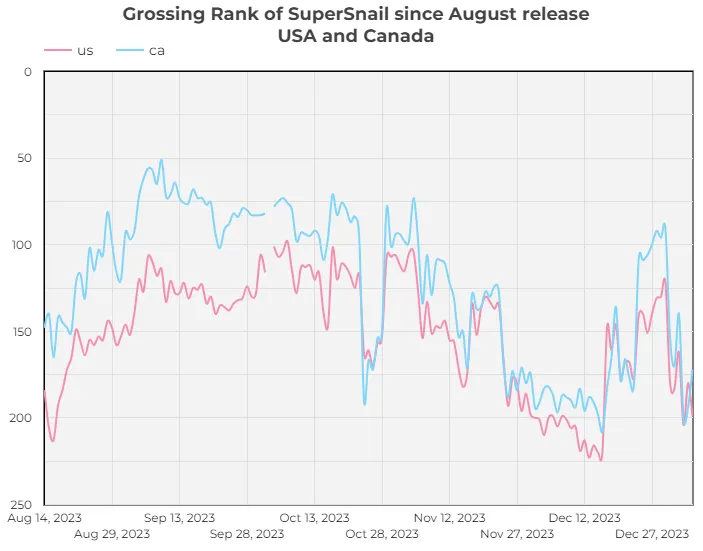

Catalyst #2 - SuperSnail worldwide release well received in North America

Being a success in China, Hong Kong and Taiwan does not generally mean that you’ll be able to scale worldwide. Different cultures, different gaming systems, etc. Yet, after their larger chinese success, Qingci got the game published in Japan (Summer 2022, hitting the top 15) and finally in October 2023, everywhere else in the world!

To our surprise, it is enjoying some level of success in both US and Canada, where it hit the top 75 and is regularly spotted in top 100-150 grossing still today on Android.

US being the 2nd biggest revenue market for mobile apps after China, this is quite meaningful to Qingci’s top and bottom lines.

Scaled worldwide, SuperSnail is a high-margin product that keeps on giving. On top of that, Qingci is working on a “H5” version of the game, which in China generally means a version that can be played in a mobile browser, directly in WeChat. Etc. That’ll help bring in new players and maintain a steady base over there, which could be another catalyst in 2024.

In short, that Snail has been reproducing and nibbling at the biggest markets, helping to scale revenues for Qingci at minimal operating cost (given the game was already developed), keeping users engaged with new content.

Catalyst #3 - CardCaptor Sakura release

A brand new game, CardCaptor Sakura was released in September and October respectively in China, and then Hong Kong and Taiwan. The game is a female-oriented, card collection casual game.

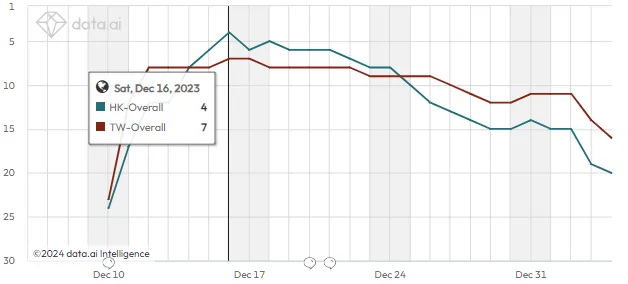

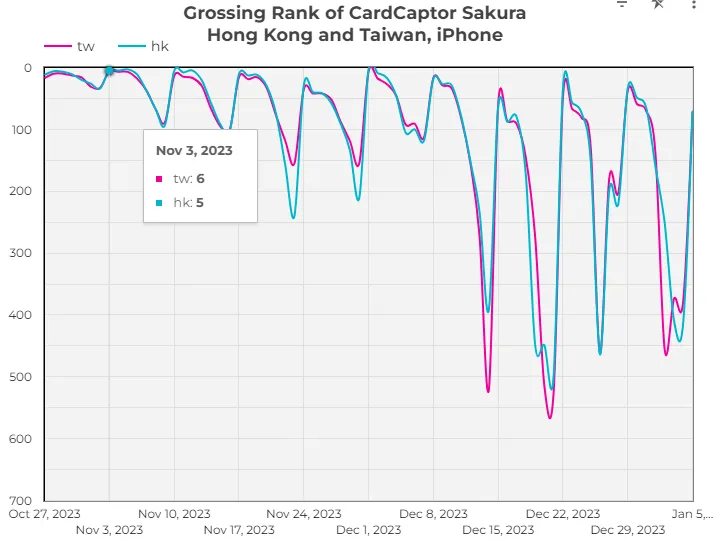

It was well received and monetized, becoming the most downloaded app in all 3 countries and hitting top 20 grossing in China and top 5 in Hong Kong and Taiwan.

See below the grossing ranks per day for the game in Hong Kong and Taiwan. You notice a pattern that we typically see in other games, whereby there are ‘updates’ pulling in new cards to collect, which drives monetization back in.

What does it all mean in terms of revenue for H2 2023 ?

What this means is that we expect H2 2023 to be an absolute screamer, up significantly from the disappointing H1 earnings. We’ll go so far as to say that we expect it is going to be their strongest earnings since their IPO in H2 2021. They are likely to announce an “exceptional increase warning” in earnings through a press release in Jan or Feb, ahead of the earnings, as we’ve seen Zen-Game and Feiyu do in the past.

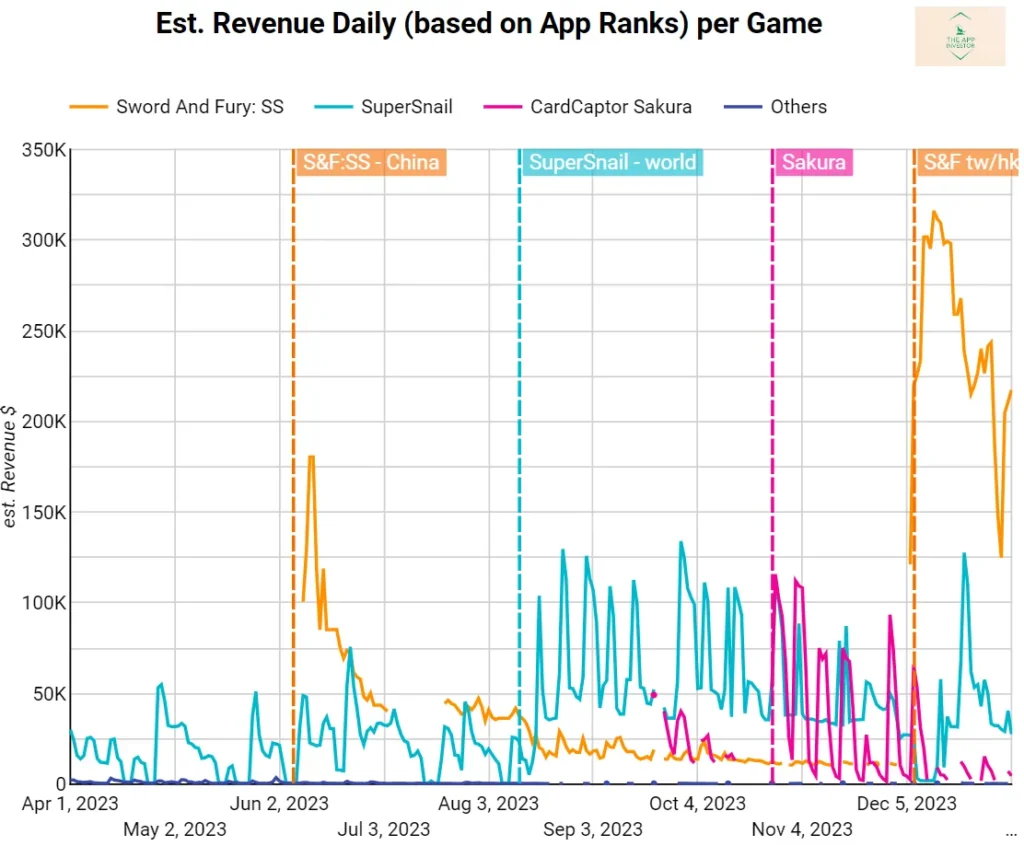

First with the Sword &Fury :SS, then SuperSnail worldwide push and ultimately with CardCaptor Sakura, Qingci were absolutely on target all H2 2023! See the estimated revenue per game (missing android China).

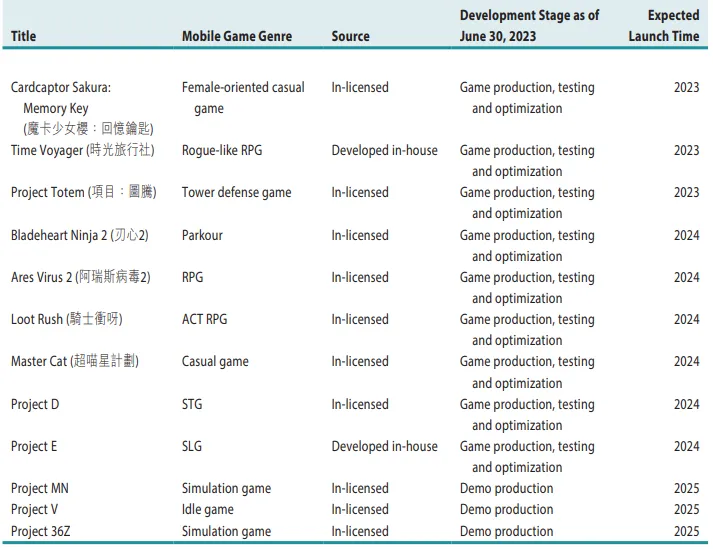

Upcoming games pipeline is considerable

Qingci has a pipeline of 4-6 games a year as shown in their latest report. It’s always difficult to predict how good they are going to be but they are in the business of building games at low cost and have access to the largest mobile gaming market by revenue in the world: Mainland China.

Their recent successes with S&F:SS show that they can indeed develop and publish more hit games in the future, but also that they can still achieve significant growth without major hits, given the size of the market they address.

That’s it for the operations, let’s turn to the stock and financials.

The stock and company valuation

Past 2 years stock behavior

As mentioned early in the article, Qingci’s revenue has been on a downward trend since H2 2020 and the huge success of SuperSnail, which was released in June 2020 for recall.

Since then, they have released a few games with mild success. Investors logically punished the stock which was driven to the current lows of HK$3.5-4.5, just a bit more than a third of the post-IPO craze 2 years ago.

But will investors reward the turnaround, once it is obvious to them? As we’ve seen with other Hong-Kong traded companies like Zen Game, the market tends to be very slow to react, but when it does, it can be very (very) rewarding.

Given Qingci seems to be commanding a decent valuation altogether from investors, we do not think it far-fetched to see it get back towards the HKD 6-8 levels in 2024. should they show the continuous progress we anticipate.

However, it is important to note that Qingci’s stock is extremely thinly traded. Mostly under the radar, not covered by analysts, with 73% insider ownership, it’s actually pretty hard to scoop a significant amount of shares, as nobody seems to be selling theirs. That means the stock can go up on lower volumes, but also that it won’t necessarily be easy to sell when the time comes.

Qingci's current valuation

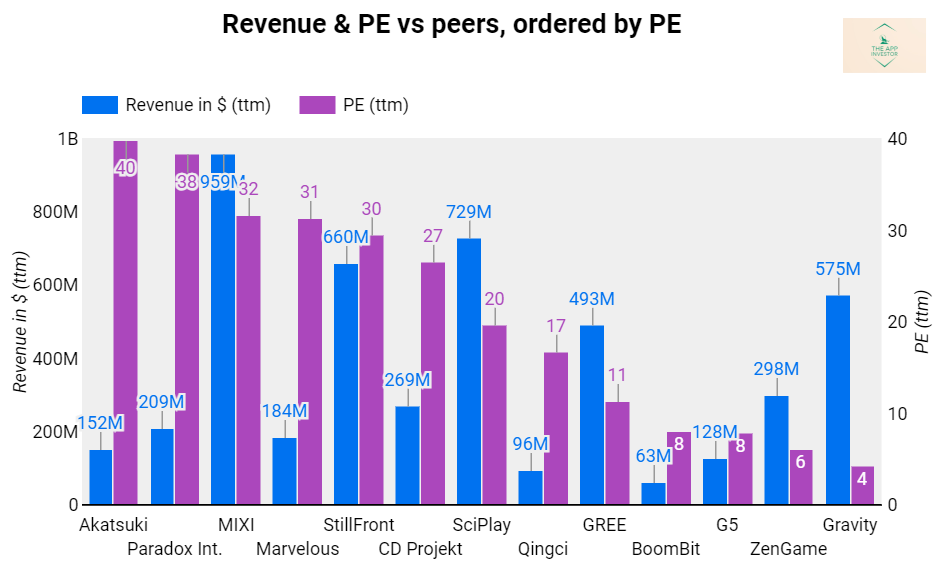

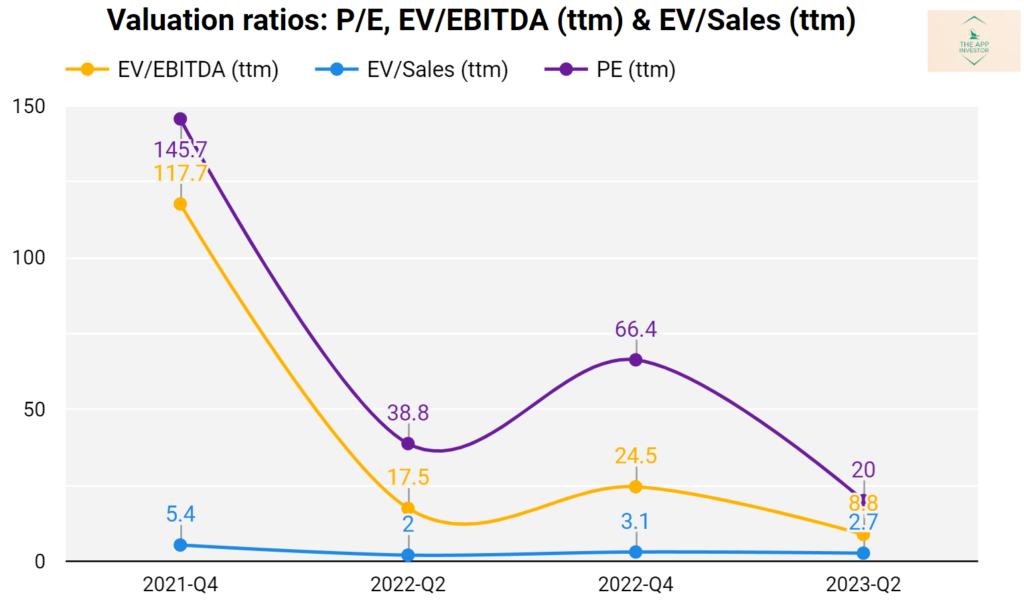

Given the last 2 periods were barely profitable and the one prior even incurred a net loss, it seems we should look at valuation through both twelve-months-trailing (ttm) and forward metrics. We could not find any analyst coverage (as usual? yep!), so we’ll use our own figures.

Starting with TTM. As of writing, the stock value is $HK 4.25, giving Qingci an Enterprise Value (EV) estimated at $US 256 millions (it’s virtually less given we expect H2 2023 to have been profitable, but let’s ignore that).

This means Qingci is traded at the following TTM ratios:

An EV/Sales of 1.9

An EV/EBITDA of 6.2

A PE of 16.7, badly impacted by H1 2023 poor profitability

One can see how its valuation is steadily improving following the too expensive IPO. Altogether and compared with a field of peers that have relatively low valuation (we like value investing after all), Qingci’s valuation is middle of the pack today.

Here are our usual comparative charts looking at PE (with revenue plotted for sizing). We selected other companies based on size (revenues)

And the EV/EBITDA and EV/Sales comparison, where it sits close to other undervalued name out there.

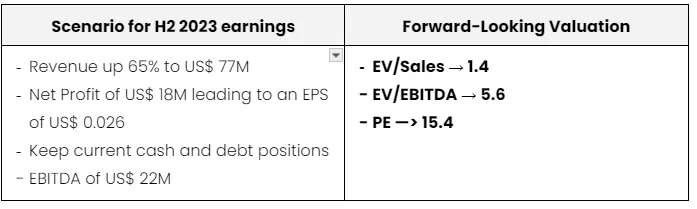

Future valuation

Now, looking forward to H2 2023 results, we’re going to guesstimate the following scenario, which we believe to be conservative (see on the right).

Because H1 2023 was barely profitable, and how H1 2024 is shaping up better, we would expect all of these metrics to keep going down and we expect a PE of 10-12 by H1 2024.

All in all, Qingci’s valuation is quite interesting looking into the future and we believe that warrants an appreciation of the stock.

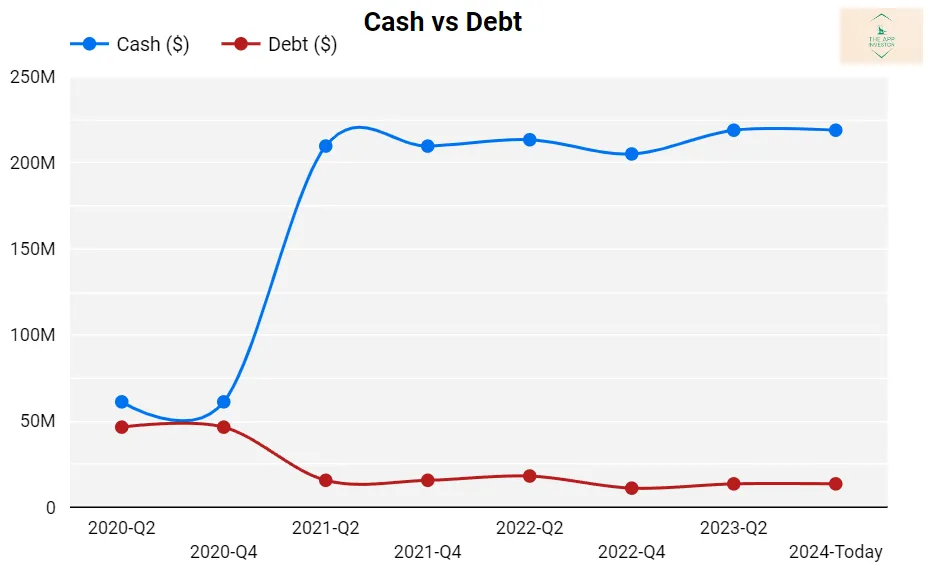

Balance Sheet

Virtually no debt and over $220M in cash as of last earnings, meaning that almost half the market cap is cash, Qingci’s balance sheet is quite strong and there’s no bad surprise around the corner. They’ve maintained really good cash discipline in the past, too. Their balance sheet will only get stronger after this ongoing period, given their major successes.

With 73% insider ownership, we would not be surprised if a dividend would come around once profitability is on the rise. It has happened in the past.

Conclusion thoughts and Pros and Cons

What we like

Their ability to keep on monetizing and growing a game that was released over 3 years ago shows the strength of their live ops and how good the game is. It’s not going to stop anytime soon, and it’s all over the world.

The S&F:SS and CardCaptor Sakura successes combined with their strong upcoming game pipeline conforts in their ability to deliver games that gets a lot of attention and monetize well.

Strong balance sheet, lower than average valuation, and recent successes ignored by the market, Qingci reminds us of ZenGame

Their ability to publish games successfully worldwide is very promising, as it gives them a huge addressable market.

What we dislike

- Qingci is very thinly traded even with a market cap to $500M, meaning the spread tends to be bigger than you’d want to if you trade regularly. We trade on a longer horizon, though, so we’re fine. Make sure you put a limit price.

- It’s a Chinese company and therefore..

- China’s chokehold on everything, including on mobile gaming has loosened but it’s still not a great country to invest in, as seen in recent news (even if they backtracked that one!).Given their games are rather idle/casual, they are unlikely to be in the crosshair of the infamous NPPA.

- To quote the WSJ on China’s economy: “(It) is struggling to shake its Covid hangover. Youth unemployment has skyrocketed, and the property market and consumer sentiment have tanked. Meanwhile, debt is piling up and foreign investors are increasingly turning their backs on the Chinese market.” It’s not ideal seeing foreign investors leaving the market, for sure.

Conclusion

With a strong catalyst mostly ignored by the market, Qingci is in a great turnaround situation with a very favorable risk-reward ratio in our opinion. We were already eying it before the S&F:SS launch in Hong Kong and Taiwan, which became the icing on the cake for us.

The company has traditionally traded at higher valuation ratios than what it will once they release H2 2023, and H1 2024 is already off to a strong start.

That is why we initiated a position on December 19th at an average of HK$ 4.10, and will keep on monitoring their operations.

Note: We promise, we’re not choosing Asian companies on purpose. Market is simply more dynamic over there, with many publicly traded, smaller companies.

GLTA!

Disclaimer

The information on this website is for educational and informational purposes only and should not be construed as professional investment advice. Please consult with a licensed financial advisor before making any investment decisions based on the information provided on this website. We do not endorse any particular investment product or strategy, and you should make your own decisions based on your own research, risk tolerance, and financial circumstances.