Zen Game & Feiyu FY23 Earning update

Executive Summary

- Zen Game (2660.HK) revenue went up 20% YoY and declared yet another dividend

- Feiyu (1022.HK) revenue went up a whooping 83% and the market did not react

Zen Game released solid FY23 earnings

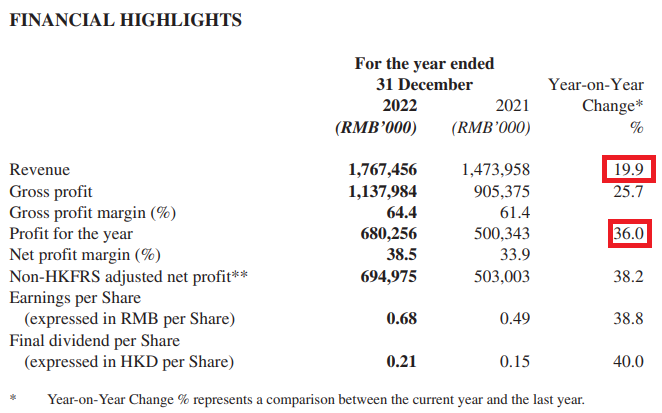

At the end of march, Zen Game released their Fiscal Year 2023 earnings. Here are the highlights:

- Revenue went up 20% YoY to US$250M

- Profit went up 36% YoY to US$100M, bringing their net profit margin to 38.5%, a 4.6 points increase from last year

Overall a strong year, with the increase in revenue mainly attributed to the strength and trend of their Mahjong games, whilst they are also being cost-efficient and closed services on a number of older games

Market reaction was fairly poor to say the least

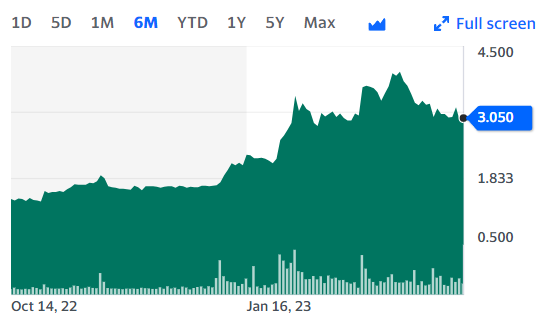

Unfortunately, the market did not react favorably as investors dumped the stock pre-earnings and did not buy again after the earnings, for lack of enthusiasm. The stock has pulled back from its HK$ 3.98 high to HK$ 3.

That being said, Zen Game is still sitting comfortably at a 120% ROI (vs a flat NASDAQ in the same period) since our initial buy decision in August 2022.

Zen Game going forward

- With a market cap of US$400M and over US$150M in cash, the stock is trading at EV below 1x yearly revenue and below 3x profit. This is incredibly low.

- As expected, they announced an annual dividend of HK$ 0.21 per share, which at current stock value represents a 7% dividend. We’ll take it.

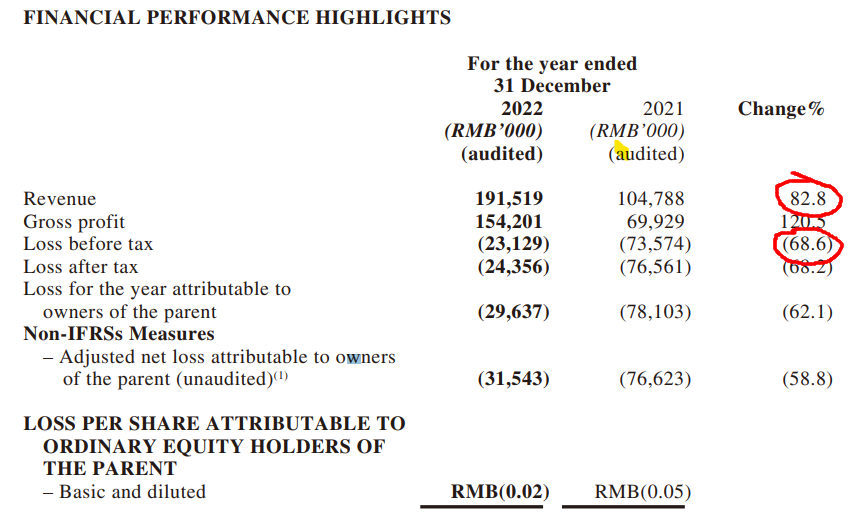

83% revenue increase YoY for Feiyu!

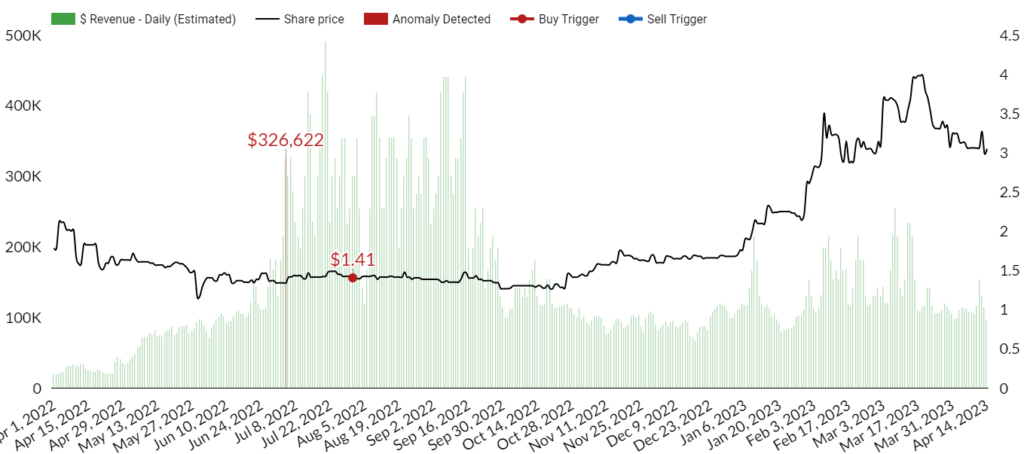

On March 30th Feiyu announced their full fiscal year 2023. For those who recall, we had estimated a major increase in their revenue expecting their second half of 2022 to be around US$ 15M (see pre-earnings update) and we were spot on. These are the highlights:

- Their second half brought in exactly $US 17M in revenue, bringing their total year to almost US$28M (CNY 191M), a YoY increase in revenue of 83%!

- Feiyu decreased their total loss before tax by 68.6% YoY

We are happy with those results but disappointed it did not lead to profitability. We have a feel that Feiyu could do more in terms of cost-efficiency.

The market could not care less

The stock had absolutely no reaction to the news. This is not too surprising given its small size (US$80M market cap), Feiyu is the type of company that fly under the radar of most analyst and institutions.

Given it’s size and volume of trades, Feiyu has surprisingly low volatility. It currently sits at an ROI Alpha (α) of 10% against the NASDAQ since we initiated it in May 2022.

So what do we do next with Feiyu ?

Overall, we are happy to keep our small position and continue to monitor their revenue and any new releases.

We believe that in the long-term, the market will reward the major improvements to their bottom-line and that the stock could absolutely fly the minute Feiyu becomes profitable again, which could well be in 2023 if they become leaner.

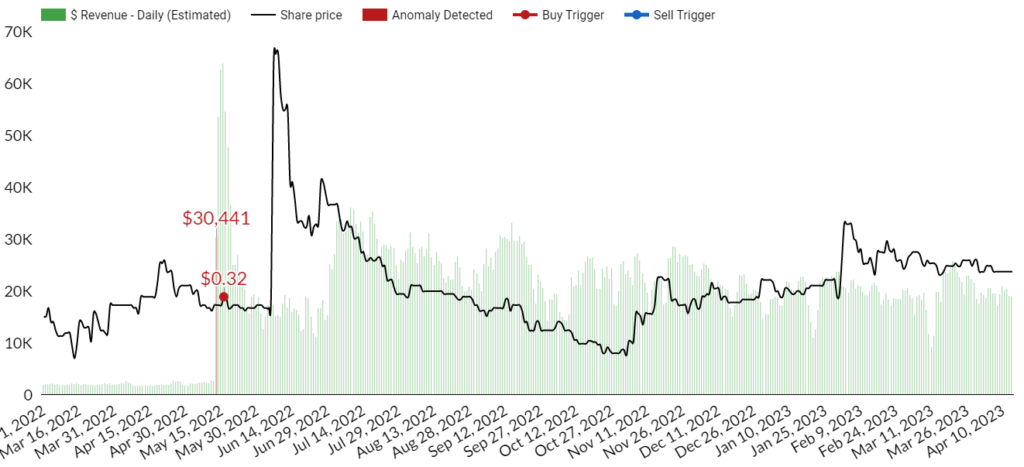

See the updated screenshot Feiyu’s estimated revenue (green bar) vs stock price (black line) since we bought Feiyu. They are clearly able to maintain their pace (US$20k/day rhythm on iOS alone), which started in May 2022.

As always – do your own due diligence and GLTA!

Disclaimer: The information on this website is for educational and informational purposes only and should not be construed as professional investment advice. Please consult with a licensed financial advisor before making any investment decisions based on the information provided on this website. We do not endorse any particular investment product or strategy, and you should make your own decisions based on your own research, risk tolerance, and financial circumstances.