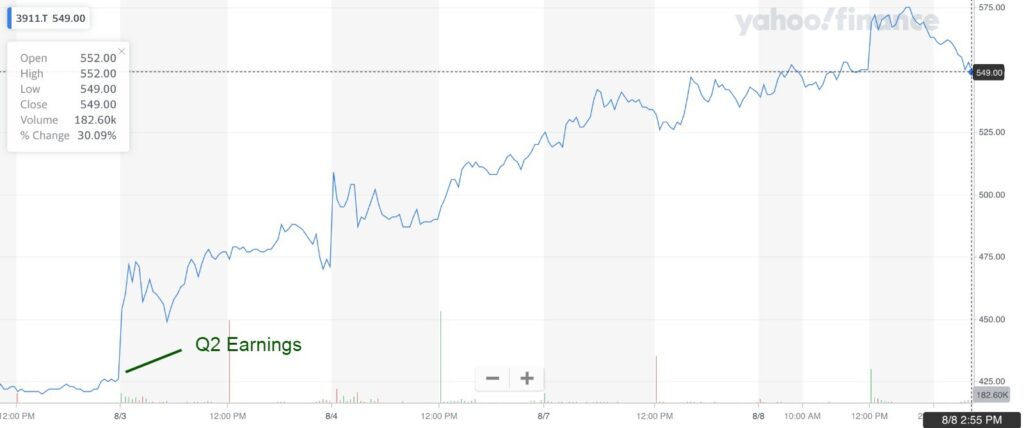

Aiming is up 30% since Q2 Earnings - a quick review

Aiming joined our Picks on December 11th 2022 (see initiation article), following the stronger than expected success of their mobile game “The Eminence in Shadow: Master of Garden” as well as a weak valuation when comparing them with new revenue and expected profits.

For a refresher, beyond our initiation we we covered Aiming operations (together with those of Gravity) in past articles here:

- Aiming (& Gravity) – 2022-Q4 earnings summary

- Aiming (& Gravity) – 2023-Q1 pre-earnings article

- Aiming (& Gravity) – 2023-Q1 earnings summary

Executive Summary

- After a plunge, Aiming’s stock rallied +30% since Q2

- The company’s operations are running well, and investors were surprised by Q2 earnings and Q3 forecast

- We keep a cool head and have neither added nor sold any stock recently, hoping it moves towards the JPY 600s this year

Q2 in a nutshell

Operations: "Eminence in the Shadow" and "Dragon Quest Tact" holding up

We won’t lie to ourselves:: we were slightly underwhelmed by Aiming’s Q2 results and quarter overall. Thankfully, other investors were not. Or rather, they had thrown the baby out with the bathwater 2 months ago..

A few weeks before releasing the nicknamed “Dancro” mobile game, they announced a 3-months delay, to “ensure the game is fully ready” for launch. That did not sit well with investors as we’ll cover a bit later.

Looking at Q2 operations, Revenue were down 25% QoQ (JPY 5’168 millions in Q1 vs JPY 3’868 millions in Q2), yet still up 27% YoY (versus Q2 2022). That decrease in revenue (which they had forecasted.. if anything, they beat their forecast yet again) is due to existing games decreasing their revenue whilst no major game was launch.

That took us a bit by surprise. We expected revenue to be down, it’s the price to pay for not releasing new games. But it that revenue drop was not crystal clear from monitoring the app ranks.

Turns out, “Eminence in the Shadow” performed as well as we expected it, but it’s rather Dragon Quest Tactics, the Square Enish published game, that did not do as well in Q2 as we hoped for.

All in all, they spent a more on advertising, and generated more revenue for it. “Meh”. Looking forward, Dancro game release is the major next catalyst, due for end of August.

Stock movement: Q2 has been a bit of a roller coaster ride

For those who did not follow closely, Aiming had dipped over 30% from it’s JPY 550+ levels. This was in our opinion due to an over reaction by investors when they announced a 3-month delay in “Dancro”, their next planned major game based on the popular anime “DanMachi” ‘s IP.

With Q2 announced, investors realized that yes, Aiming’s revenue hit their earnings forecast without the game being released. That drove a 30% rally in stock value in the 2 days following the shareholder meeting. Dust is yet to settle, but we are playing a longer game with this one.

Also, we believe their Q3 earnings forecast took investors by surprise, with an expected revenue forecast of JPY 6’071 Millions, vs JPY 3’868 in Q2, a 57% increase in revenue. Aiming’s management is citing increases sales due to the release of “Dancro” as well as the 3rd anniversary event of Dragon Quest Tact, their hit game (published by Square Enix).

Should Dancro be a major success, we expect the stock to rally to above the JPY 600s.

Conclusion

Not much to see here - we stay as is

With higher than expected Q3 forecast, Aiming’s management now need to deliver on this and fast. Dancro will only contribute to 1 months of revenue next quarter, so we are on the cautious side regarding their ability to hit those forecasted revenues. We also expect them to go hard on the user acquisition button, so advertising costs will increase, which means Q3 is unlikely to be profitable, yet again.

Yes, strong releases with good marketing and user acquisition push lead to long-term profitability as we have seen with “The Eminence in the Shadow”, but they need to show an ability to maintain revenue and profitability longer term.

With that we are not adding or selling any shares of Aiming. Overall, we’re +31% since buying in December 2022, which is just 3% better than what the NASDAQ has done in that time. Still, it’s more than can be said from a lot of smaller tech companies, but quite far from the returns Gravity and Zen-Game have returned in a similar timeline.

GLTA!

Disclaimer

The information on this website is for educational and informational purposes only and should not be construed as professional investment advice. Please consult with a licensed financial advisor before making any investment decisions based on the information provided on this website. We do not endorse any particular investment product or strategy, and you should make your own decisions based on your own research, risk tolerance, and financial circumstances.