Aiming Update - Why the stock plunge and where do they stand?

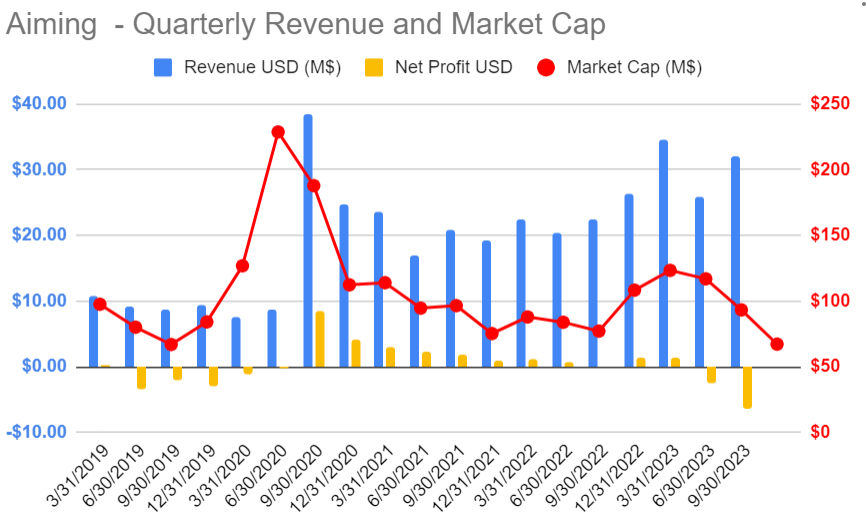

We initiated Aiming (3911.T) , a Japanese video game developer and publisher, on December 11th 2022 at JPY 415, following the strong success of “Master of Garden” mobile game. After initially going up to JPY 550 (+45%), the stock plunged to JPY 245 (-40% ROI) at time of writing, a sharp decline. We take a look at why it went down, and whether investors threw the baby with the bathwater.

Previous Aiming articles:

Executive Summary

- Aiming Inc’s stock plunged first due to DanMachi (“Dancro”) delay in release, and then due its relatively poor game performance versus expectations

- This led to relatively slow Q3 earnings, coming in far below guidance and in loss income territory. The stock dropped 26% post earnings day

We believe Q4 could surprise investors with the performance of Master of Garden in Taiwan and Hong Kong going unnotived, as it is published by Softstar not Aiming

Looking at valuation and balance sheet, we are not concerned and keep Aiming stocks. Do we have regrets of not selling after Q2 ? Yes. Would we buy again now? Probably.

Let’s dig in!

Latest Updates: Q3 Earnings and ongoing Operations

Past earnings update - Q3-2023

Aiming announced Q3 numbers, and it wasn’t all rosy:

Revenue came in at US$ 32M, a 24% increase QoQ and 43% increase YoY, but 20% short of their US$ 40M guidance

Net loss came at a US$ 6.35M, against an expected US$ 1.2 M loss. Ouch.

Aiming’s CEO explained those results with the less successful than expected release of their latest DanMachi game. This came as a surprise given how popular this anime franchise is in Japan. The reality is that gamers flocked to the game, but they did not stay. They pumped a lot of ads dollars on user acquisition. but if the game was not good enough.

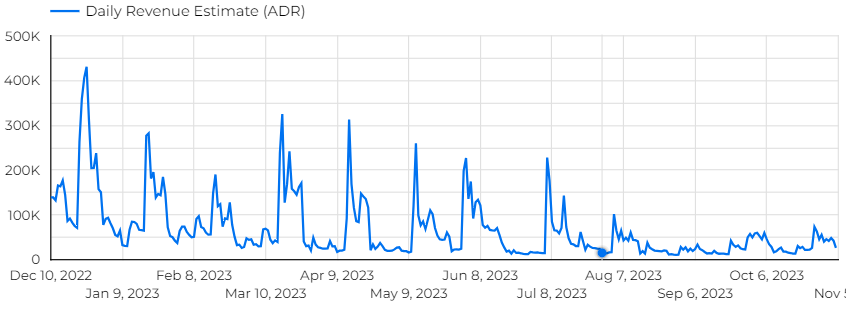

Of course, Master of Garden and Dragon Quest Tact (published by Square Enix) kept on generating their fair share, being the long-tail revenue successes they are.

Operations in Q3 - the games

DanMachi release: expectations not met

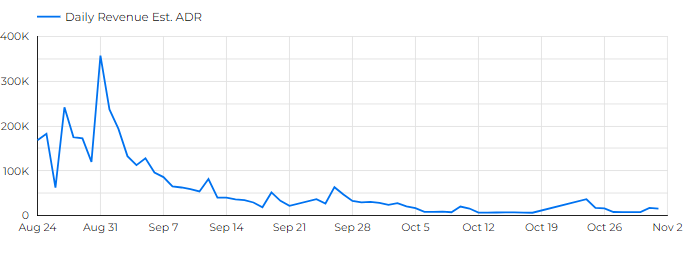

Danmachi Battle Chronicle was released on August 24th, a good 3 months after it was initially planned to release and a month and some before the end of Q3. Danmachi is a very popular anime franchise, and the game hit 3 millions in downloads very quickly. That is quite considerable in the space, so the story started out well. However, in terms of in app purchases, it did not perform. At its peak, the game initially hit top #15-20 grossing ranks in Japan and top 20-50 in Hong Kong and Taiwan. Unfortunately, 2 months and some later, it’s sitting in around the 120th overall grossing rank on iPhone and 175th on Android in Japan, and beyond the 300th rank in other countries.

That is very underwhelming and we hope that either they are not spending all that much in advertising and live ops in this game anymore, or they have another plan on how to improve and relaunch. The game was also delivered on PS4, which is typically requiring fronting a lot of the expenses, and help explain the revenue increase even as the game did not perform so well on mobile.

Master of Garden - The gift that keeps on giving

Master of Garden has been a main revenue driver and what triggered our decision to select Aiming has a Pick end of last year. As one can expect, its revenue in Japan as going down steady with time, as it is typical of 99.9% of successful games. We show a graph of rough estimates of the games daily revenue through time in Japan.

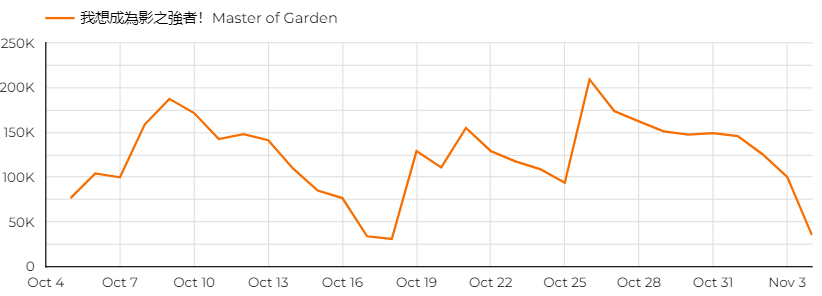

However, unnoticed by most investors (at least we believe), the game has been released with great success in early October in Taiwan and Hong Kong, published by another public company, Softstar. Hitting top #5 in terms of grossing, it was still in the top 10 on Android after a month, and is now slowly starting to loose steams. Given Hong Kong and Taiwan are large market in terms of mobile spending (Taiwan is #5 in the world, on equal footing with Germany), this is very notable.

What portion Aiming ultimately receives from that HK/TW success, we do not know, but we assume it’ll bring at least US$ 3-5M of high-margin revenue (they do not publish it) to their Q4. All in all, we believe Master of Garden to be the main driver for a better than expected Q4.

Stock, Value and Balance sheet updates in Q3

Stock: The great plunge

Stock went down in Q2 from JPY 550 to JPY 305, before earnings, a massive 40% drop in less than 3 months. On earnings (October 27th), the stock dipped another 26% to JPY 225 levels.

Since then, a few foxes came in and stock regained some love, sitting at JPY 265 at time of writing, still less than half its value from the summer. No crazy volume was registered. Simply put, everybody was selling.

Aiming’s valuation is very interesting at these levels

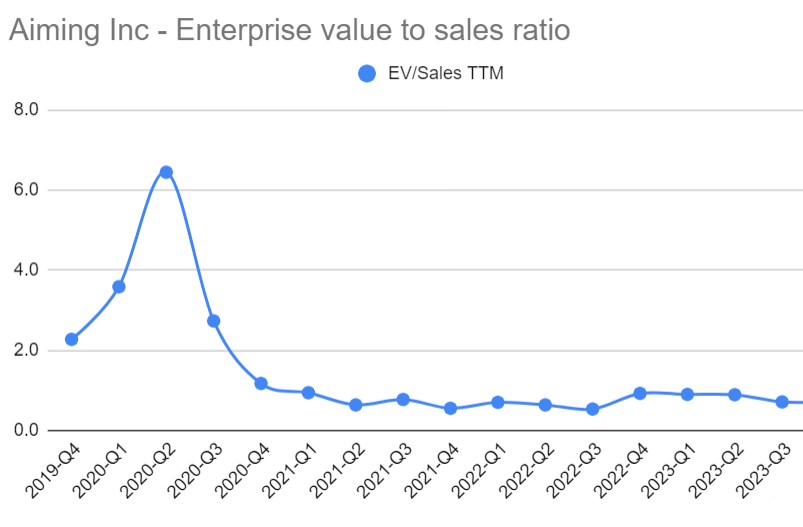

This puts Aiming Inc. at a US$ 64 millions Enterprise Value. Looking at PE or EV/Ebitda is not very meaningful for a company in search of profitability, so let’s review their EV/Sales.

With approx. US$ 120 millions in Revenue (TTM), Aiming stands at 0.7 EV/Sales ratio (we simplified to revenue = sales).

For reference. Leyou was acquired at a 7 EV/Sales ratio by Tencent, Zynga at 4.5 by Take-Two Interactive and Glu Mobile at a 3.75 by Electronics Arts, so from 5 to almost 10 times higher valuations.

Using that same metric, only Gravity (NASDAQ:GRVY) has a lower ratio (0.2 !) from companies we follow. That being said, Gravity’s EV ratios are a bit biased given their $320M cash chest and no debt.

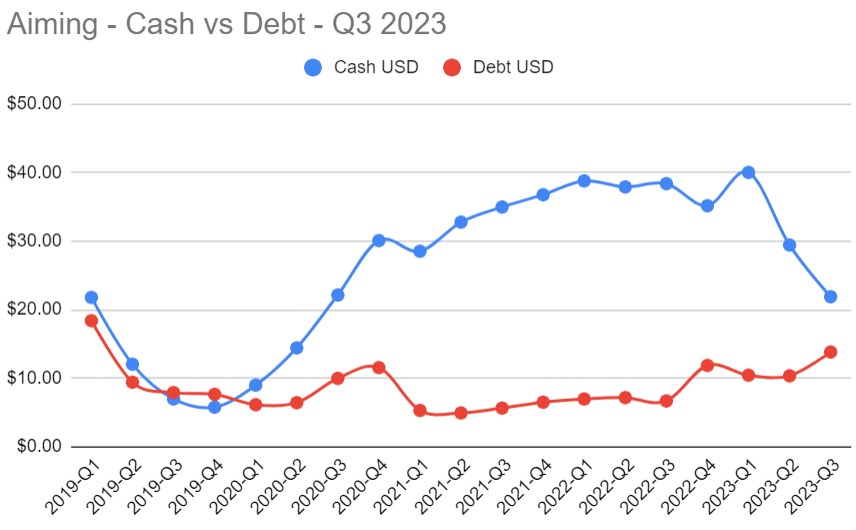

Aiming’s balance sheet is strong, but weakening

We love cash-rich, debt-free, profitable companies on the cheap. That’s always been our focus, with Gravity and Zen-Game at the top of the list. Aiming was more of a ‘returning to profitability’ scenario starting Q1 2023.. We were right for that, but unfortunately, DanMachi delays and fairly average reception coupled with heavy ads spending means Aiming’s position has not improved as much as we were hoping for. Cash & Cash equivalents stand at US$22M, almost half that of Q1. With overall low debt below US14M, Aiming remains in a comfortable position, far from being leveraged like many others in the industry.

They do however have to improve on operating margin (we saw a steady increase on employee count) and spend more wisely on UA. When they do, they could be very profitable again.

Pros and Cons

What we like

Very low valuation after the stock plunge, investors have overreacted in our opinion. Lucky for those who want to build a position.

With 28% insider ownership, their interests are aligned with those of shareholders in the long run.

Proven ability to deliver good mobile and console games with long tail revenue. Master of Garden is one of them, yet company valuation is lower than before it got out. That does not make sense to us.

Aiming’s investors are reactive. It’s not easy to be faster than the horde, but at least you know that the stock goes up when operations are going well.

What we dislike

Inability to successfully monetize a Danmachi-franchise game is worrying. Maybe they felt the pressure to push the game when it wasn’t fully ready after the first delay? Better off not giving dates and expectations in our perspective.

Last quarter was strong in revenue but it came at a higher then anticipated cost.. Even if they say they’re bearing the development costs upfront, that’s everyone in the industry and no excuse for it.

Game pipeline is unknown to investors. They work on multiple ‘unnamed’ projects but nothing seems at the readiness level that it could be released this year.

They have increased headcount. Barring cuts, their cost of sales are likely to be kept high.

Conclusion

Should we have sold when the market caught up with the news of Master of Garden getting significant traction, and as DanMachi was not the success expected? Yes, we regret not selling those shares. We stayed in given their games were still performing well and the upcoming release of DanMachi Battle Chronicle was a major catalyst. It ended up being a lower-performing game, with higher user acquisition costs than we expected and lower ratings. It’s never easy to accept that our +45% ROI could turn into a -40% ROI in a few weeks.

However, we think there’s only minimal downside from current valuation. With DanMachi user acquisitions costs down post-launch and Master of Garden strong performance in Taiwan/Hong Kong, we expect a stronger Q4 than most investors are, and an opportunity for short-term investment.

Disclaimer

The information on this website is for educational and informational purposes only and should not be construed as professional investment advice. Please consult with a licensed financial advisor before making any investment decisions based on the information provided on this website. We do not endorse any particular investment product or strategy, and you should make your own decisions based on your own research, risk tolerance, and financial circumstances.