Q1 Pre-Earnings update: Gravity & Aiming

Executive Summary

Gravity and Aiming are about to roll out their Q1 earnings in early May, so we thought we’d provide an update on both their operations and stock since the start of the year!

Gravity

- Gravity’s stock closed at $53.53 as of April 25th, up 9.60% since their most profitable ever Q4 earnings. It first shot up to $65, a 33% increase but struggled to keep momentum.

- Operationally, Q1 2023 is shaping to be another very strong 3-months for Gravity, with both RO: Next Gen and RO: Origin games performing well. Q2 has started even better with Origin a MAJOR hit in South East Asia at the moment of writing

Aiming

- Aiming’s stock closed at JPY 449 as of April 25th, up 26.48% since their earnings (to be fair, the stock had been battered since the new year!)

- Operationally, Aiming has continually to successfully maintain its live operations of Master of Garden as their key game of the moment. They also announced two exciting games come next two months.

- Q1 is looking decent: we expect less revenue and much less SG&A expenses and are hoping for an increase in profitability

Gravity Update

We last updated on GRVY in February following their blowout Q4’22 earnings, attributed to Ragnarok Origin’s (“ROO”) massive success in Taiwan and Hong Kong. For reference, Taiwan is estimated to be between the 5th and 7th largest country in the world in terms of in-app revenue, with a 3% total market share. That’s on par with Germany!

Since then, Gravity has had an eventful and strong start to the year from an operation standpoint. Let’s dig in.

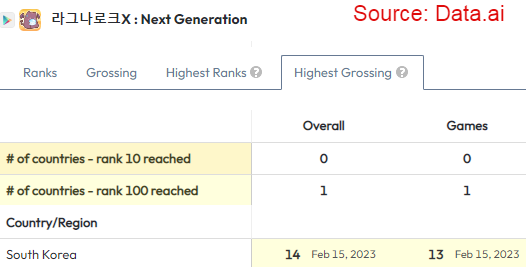

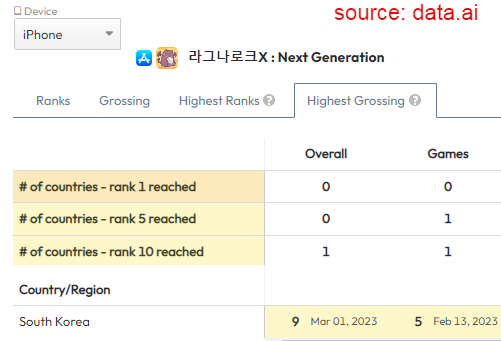

Ragnarok Next Generation released in South Korea

For the first time since July 2020 (Ragnarok Origin release), Gravity released an “A” game in South Korea, their home ground, with Ragnarok Next Generation (ROX). As a reminder, South Korea is the 4th biggest market worldwide in terms of in-app spending, nothing less.

Given how ROX has been successful throughout South East Asia in the past, we had high expectations for this release, which were met. Not exceeded, but certainly met. The game hit the top 10 grossing in all 3 stores (South Korea has the “ONE” store, which actually drives more sales than the iOS store over there. They’re serious about their android consumption, we tell ya!)

All in all, we do not expect ROX to be driving the same kind of revenue ROO was back in 2020 in South Korea, but it should still bring a significant boost to revenue in Q1 and beyond.

Ragnarok Origin (“ROO”) going strong and expanding

ROO is still going strong in Taiwan and Hong Kong – oscillating between top 5 and top 30. If you recall, this release was the main driver of the Q4 blowout. Whilst its revenue is certainly going down little by little as expected, ROO Taiwan is proving sticky and will have a long tail of revenue, see its daily revenue estimate (mobile only, the game is cross-platform with PC).

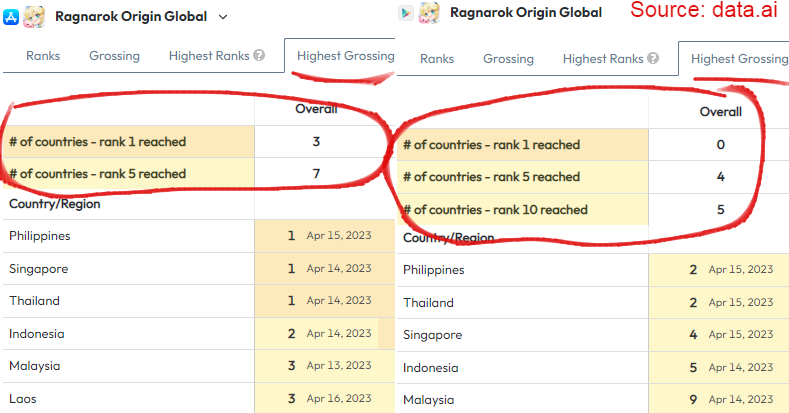

Ragnarok Origin Launch in SEA

On top of that, ROO was also released in a multitude of South East Asian countries, and we dare say it was the most successful release ever with over 10M user pre-registered. This number is huge for any game worldwide, so imagine for just a few countries in South East Asia. Obviously, a release in April means this will only impact Q2, but we cannot hide our excitement at this !

Thanks to that, the game is trusting the top 3 grossing in most countries it’s been released.

We believe this will bring somewhere between $250K to $500K of daily revenue in Q2, given those are smaller economies such as Thailand, Philippines, Indonesia and Malaysia, where disposable income does not allow players to spend as much as Taiwan, South Korea or Japan.

That being said, those are fast-growing and digitalizing economies so it’s very encouraging to see the dominance of the Ragnarok IP over there. We like our long-term odds with that!

Gravity conclusion: phenomenal start to 2023

All in all, with those two releases and looking at all games performance, Gravity is off its best year start ever recorded, they are doing fantastic in terms of execution.

The market has shown some italian love to the stock, rewarding the company for their blowout in Q4 and punishing it for doing great in SEA too ($48 → $65 → $53)

Some valuation numbers, at share price of US$ 53,53:

- Gravity is valued at a market cap of US$ 372M

- With virtually no debt and a mountain of US$ 260M in cash

- Giving us an EV of US$ 110M at the time of this article

This means that, looking at the yearly picture (which is much less rosy than the last quarter picture):

- EV to revenue is at 110M/372M = 0.31x

- EV to EBITDA at 110M/90M = 1.22x (For reference, TTWO is at 32x, ATVI at 24x, EA and NTES at 14x.

With that, we still can’t shake our feeling that this valuation is nonsensical and we even added on the recent dip. GRVY is our largest holding, and we’re hoping they will start to use that cash chest in a way that ultimately rewards shareholders. A fool’s hope, maybe. Time will tell, value will prevail!

Aiming Update

Operationally... Steady as she goes

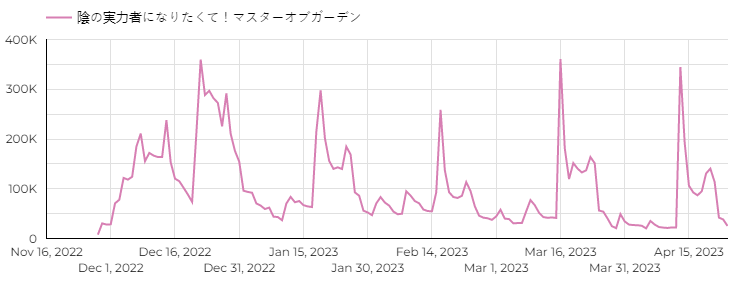

Let’s start with the operations, as there are some good news coming out for Aiming since their past earnings. Master of Garden, the successful release that triggered our interest, has a typical “update-based” grossing pattern. This means we see the game dropping in the ranks (and therefore in revenue), and when the developer drops an update, it flashes back up with existing users buying in-game items. See how that pattern is obvious on our revenue estimate chart for this game (title is in Japanese, Master of Garden being a translation).

This goes to show Aiming are doing well in successfully maintaining the game’s live operations so far.

New Game releases in Q2

Beyond that, they announced a new mobile game to be released on May 23rd, based on the popular anime IP “Danmachi”. The game is named “Is it wrong to try to pick up girls in a Dungeon? Battle Chronicle”, so something for us to watch out for in Q2. The game is translated and will be made available in 80 countries, see its official website for more.

And as if that was not already exciting enough, Aiming just announced today the launch on June 6th of a game and a manga named “Kaminaga Shijima ~ Rinne no Miko ~” jointly with LiTMUS Co, a subsidiary of UUUM Co (Ticker 3990 on Tokyo Exchange) and Kodansha Co

Needless to say that at this stage of their progress, another strong reception for one of their games could be a strong catalyst

Stock action: Reaction to Q4 earnings and what to expect for Q1 ?

As a reminder from our previous article, Aiming earnings in Q4 came out at US$ 29.25 millions, beating Q4 forecast of US$ 21 millions by a 40% margin, but failed to achieve profitability mainly because of high SG&A expenses in the form of user acquisition & marketing.

How did the market react ? Aiming is up above 26.05% since the earnings on April 14th, so we will take that.

Q1 Earnings:

Looking towards Q1 and given the game performance highlighted previously, we are cautiously optimistic and think Aiming could be much more profitable in Q1-2023 given:

- Master of Garden was released in mid-end of November and contributed a full quarter to Q1-2023, versus only a month and a half to Q4-2022. Given the top-line beat in Q4-2022, we believe revenue will also come higher in Q1-2023.

- We expect SG&A cost to be lower past the initial launch. Usually publishers will pump a lot more into advertising and user acquisition at the launch, to ensure it gets traction.

Conclusion: Keep calm and hodl ?

Put simply – Aiming is unlikely to be the next video game unicorn, but they are on a positive run. With long-tail revenue expected from current games and 2 awaited new game releases in the coming 2 months, the sky ahead is clearing.

This positive shift has not yet been appreciated by the market in our opinion. Since we initiated our position, Aiming is up 7%, against 10% for the NASDAQ. Given it’s a fairly small company at US$ 135M market cap and traded in Japan, it’s not too surprising..

We decided to keep our full position on Aiming ahead of their Q1 earnings expected the 2nd week of May, and we’ll play it from there.

As usual, do your research, ask your questions and GLTA!

Disclaimer

The information on this website is for educational and informational purposes only and should not be construed as professional investment advice. Please consult with a licensed financial advisor before making any investment decisions based on the information provided on this website. We do not endorse any particular investment product or strategy, and you should make your own decisions based on your own research, risk tolerance, and financial circumstances.