Quarterly earnings - Update on Gravity & Aiming

Executive Summary

- Gravity (GRVY) and Aiming (3911.T) are part of our active picks at this day and have just released their latest quarterly earnings – time for an update!

- Whilst both company imploded their forecast, Gravity absolutely blew everything with their strongest quarter ever

- We are only adding to our positions at this point

Gravity - Biggest quarter ever, just that!

On Feb 14th 2023, Gravity released their 4Q and full fiscal year (unaudited) 2022 results. We had high expectations, because we initiated a position in September due to the very successful release of Ragnarok: Origin in Taiwan and Hong Kong.

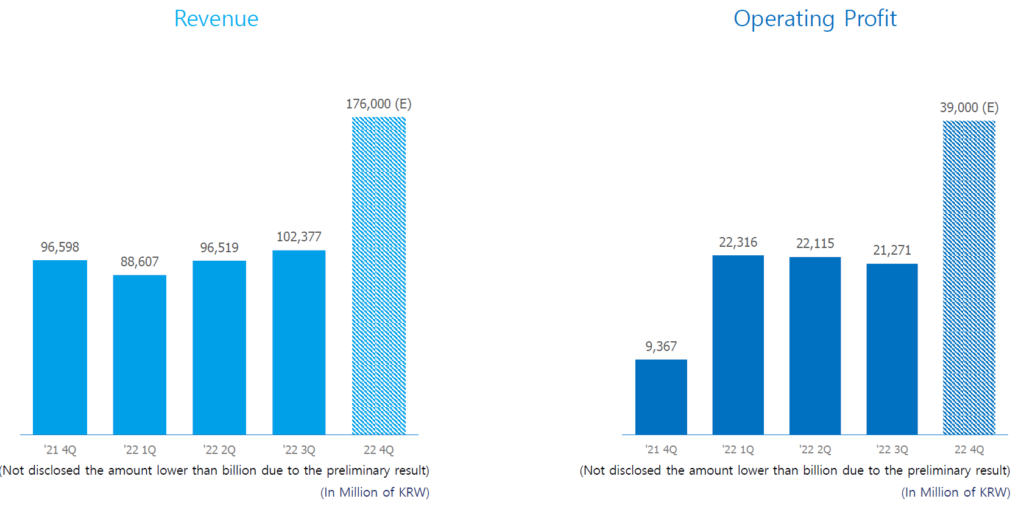

And boy did they not disappoint. We could not have hoped for a better quarter: at KRW176 millions or US$ 135 millions, Q4-2022 is their biggest quarter revenue ever.

It is also close to their highest operating profit at US$30 millions, only slightly beaten by Q3-2021 (US$31 millions).

Ultimately, for video game companies that size, what really matters is the annualized picture, because quarterly views depend too much on game releases.

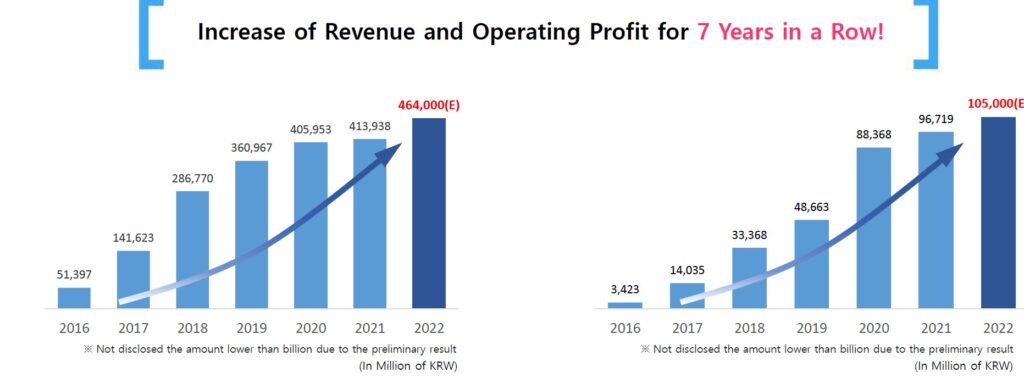

7 years of revenue and profit growth and the most ridiculously low valuation

You will be happy to know that 2022 is now Gravity’s 7th year of revenue and operating profit growth in a row, as shown in those graphs taken from their investor presentations.

At US$ 48.82 pre-earnings, Gravity market cap is US$340 millions, and with a US$260 M cash chest, makes their pre-earnings EV at a whooping US$ 80 millions. Factor in their FY2022 revenue of US$ 357 millions (above their market cap!), for an approx. net yearly operating profit of US$ 81M, and you have gotten yourself a seriously under appreciated, rock-solid company. Again, 7 years of growth in a row. Just saying.

We are not the only one that noticed – this recent Seeking Alpha article looks at Gravity (pre this monster of a quarter) from a financial metrics standpoint.

Aiming released big numbers, on both side

We initiated a position in Aiming (3911.T) in December 2022, after the very successful release of “The Eminence in Shadow: Master of Garden” in November. We assumed US$25-US$30 millions in quarterly revenue for this game only, and given the game was released mid-quarter and their past quarter revenue was US$¨25 M, we swooped in a few shares, expecting a good quarter. At US$ 29.25 millions (JPY 3’942 millions), Aiming beat their Q4 forecast of US$21 millions by an almost 40% margin, and their previous Q3 by 17.9%.

Bang on? Jein, as the Germans say. That success came at a cost, and it was higher than we expected. They pressed hard on the advertising button based on the earnings presentation, and their SG&A expenses went up 42.7% QoQ to US$17.6 millions.

What’s next for Aiming ?

We sound disappointed, but we remain very positive. SG&A are high because they saw the game was popular and loved, and decided to pump some good old user acquisition. Getting your game to the top 5 usually brings a much longer tail than a game in the top 20, and we think these marketing expenses will pay dividends in the long run.

Q1 is off to a very strong start and we believe that Aiming will turn a quarterly profit for the first time in a few years in Q1-2023, so we are adding to our position and patiently wait for the next earnings release to prove us right, or wrong!

GLTA!