Gravity Q3 2023 updates - pre-earnings

This is the last in a series of updates about Gravity (NASDAD:GRVY), one of our Picks since October 2022 and our initiation article. In our latest article, we had anticipated a strong Q2 due to the absolutely phenomenal operations of Ragnarok Origin in SEA. In this article, we will review Q2 earnings and see how our optimism was far too conservative, discuss Q3 operations and stock movements, as well as what to look for in Q3 earnings on November 13th. And lots of graphs and numbers.

Previous Gravity updates/articles:

Executive Summary

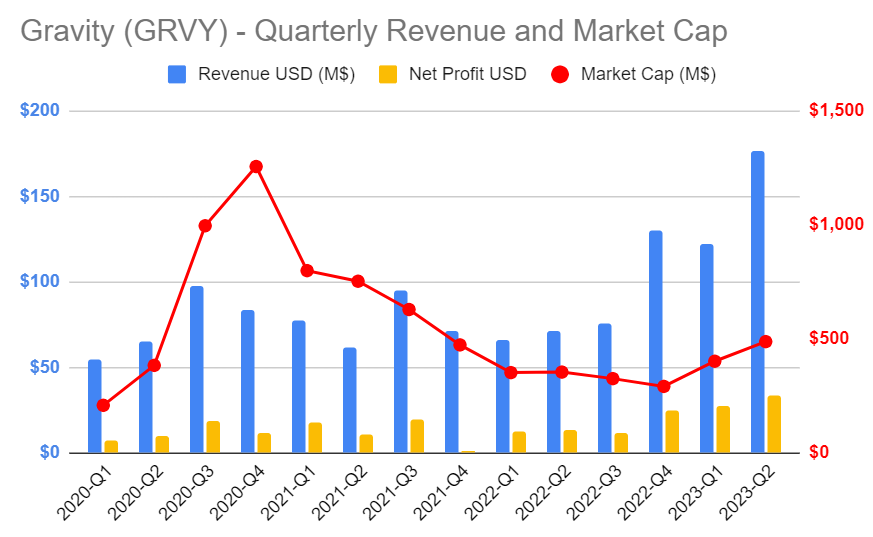

- Q2 revenues came out at ~US$180M, a 45% increase QoQ. Net income hit US$33M, a 22% increase QoQ. Monstrous.

- Q3 Ops were average, driven by ROO SEA long tail of revenue. Due to no major release, it will fall short of Q2 by a margin, as expected. Throwing a 0 confidence guesstimate: revenue could come in at US$110M and net profit at $US22M.

- The 6-months pipeline is alright but not much more, with ROO China announcement for January being the surprising highlight. Investors underestimate this in our opinion.

- Valuation makes very little sense at these levels – we are not ready to sell one share, even as we sit at +37% from our $46.2 October 2022 haul.

Let’s dig in!

Latest Updates: Q2 Earnings & Q3 Ops

Past earnings update - Q2-2023

Q2 was always going to be a strong quarter, given that Ragnarok Origin SEA had reached 10M pre-registered users. The game logically and directly hit #1 grossing on Apple and Android stores in all countries.

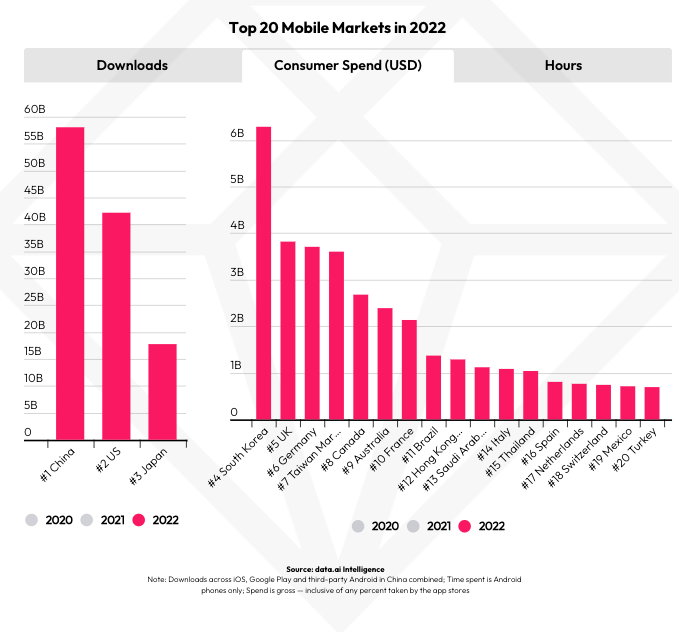

Our initial expectations on Q2 were tamed by the fact that these countries are generally on the lower-end when it comes to user spending, especially when compared to South Korea and Japan. Boy were we conservative on this.

Q2 came out at ~US$180M, a 147% increase YoY and 45% increase QoQ. Net income hit US$33M, also a 150% increase YoY and 22% increase QoQ. Needless to say, this was the stronger quarter in history for Gravity (see figure).

Actually, the last 3 quarters are the most profitable in history, a strong sign of growth, bringing their cash chest to $US307 millions.

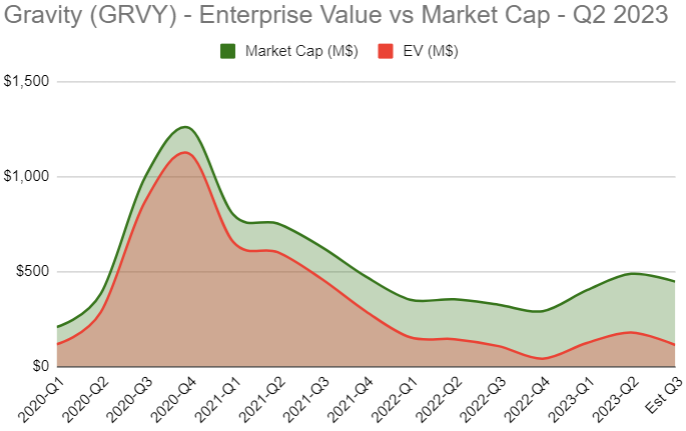

These numbers paint an undervaluation story for Gravity’s stock, which is becoming more and more evident since falling from its COVID times $215 high.

After beating the previous 2020-Q3 revenue and profit records 3 quarters in a row, GRVY was sitting at $70 (3 times less!) at the time of earnings, bringing its market cap to US$488, and making the stock 63% cash as of June 30th 2023.

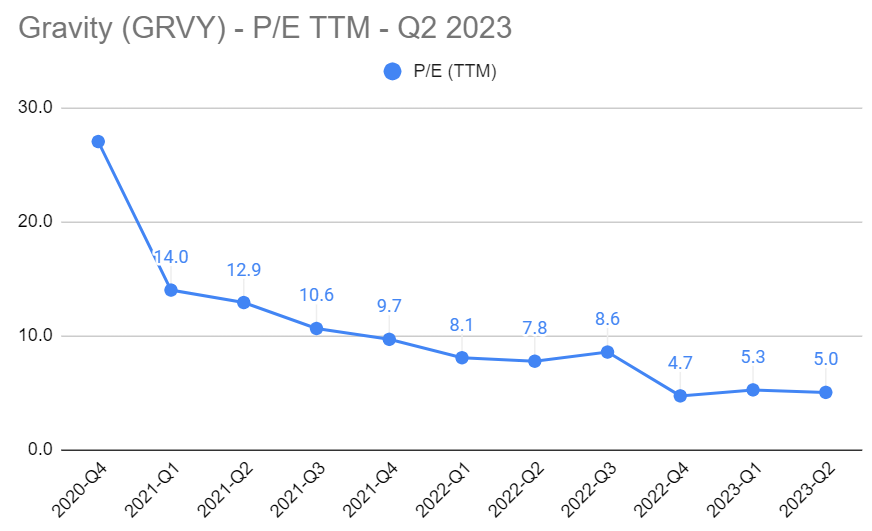

At US$4.9 earnings per share, Gravity bears an ever-declining P/E (TTM) of 5.0 (see figure).

As covered later in the article, this case is even strengthening into Q3.

Operations in Q3 - the details

Ragnarok Origin over time

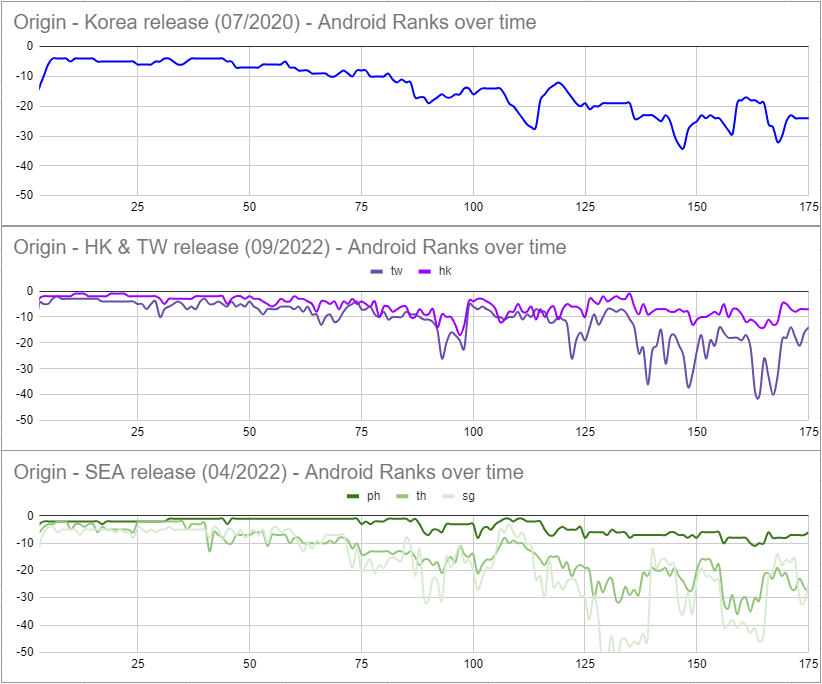

Obviously after Q2, it’s all eyes on RO: Origin in SEA. Unsurprisingly, after a full quarter, the game’s grossing rank started to falter a little, in a similar fashion to previous releases in South Korea, Taiwan and Hong Kong (see figure comparing all 3 releases of ROO).

Nothing worrying, but with no major release and given the incredible Q2, it means Q3 will fall short Q2 by a good margin. We’re throwing a guesstimate of $US110M out there, with $US22M in net profit.

Meanwhile, Origin Hong Kong & Taiwan had their 1 year birthday since release and has now stabilized between the #50 and #100 top grossing rank. Origin South Korea is still around the #100 to #300, 3 years after its release, and that even after ROX Korea release cannibalizing some players. This shows the meaning of long tail revenue for Gravity’s flagships.

Q3 Game release: The Surprise and the Flop

The surprise: Ragnarok Landverse is another tweaked “Ragnarok Online” (oh, that cow is milked dry alright). They basically implemented an NFT marketplace on top of their “gift-that-keeps-on-giving” PC game, and voila, Landverse was born September 20th. So it will not impact Q3 significantly.

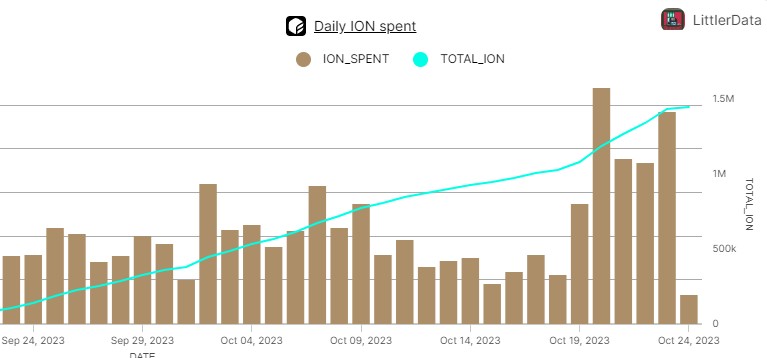

The game is widely decried online as a failure, because every forum is full of players that are not willing to spend a dime and chase free private servers. But the reality is that Landverse servers are full and Gravity is able to monetize the game even without it being a hit. From overall activity on forums, reddit etc., we assume 20-30K players at the very least.

Gravity (and Maxion) makes money when users buy in-game gold (“moonstones”) as well as when they trade minted items (20% fee). The more players, the more gets sold, the more gets sold, the more they make. You get the jist.

This type of games attracts whales like a sea of planktons, and looking at ION transactions (base currency for the game), there are about 4-5K users minting ION and other items in the game. Between moonstone purchases, transaction fees and pre-purchases, the game has generated around $1.6M or $50k/day, seemingly increasing to $80k/day at time of writing. Vast majority of it being moonstones purchases. (See data here, credit to LittleHelper for the fantastic work with this dashboard).

The Flop: On top of Landverse release, Gravity released “20 Heroes”, a “retro-RPG” allowing users to.. Well honestly we know little about it. It’s only released in Korea and was a total flop, so don’t expect revenue from that one, at least not in its current version.

Q4 & Beyond: ROO China

The Big News: Looking into the future, we received probably the most impactful news in a very long time. Ragnarok Origin got approved for a license in China, after years of waiting, and should be released for the Chinese new year in January 2024. It currency sits close to 1 million pre-registered users (source: https://ro.ruyi.cn/act/register/index.html)

As you probably know by now, the game was not developed by Gravity, and will not be published by Gravity either, but by Ruyi (even though IR denied it when we wrote to them..they know nothing). So Gravity stands to gain royalties from the game in China, for the use of their Ragnarok IP. How much of it? We likely will not know before these $ start rolling into Q1’2024 earnings. But what it means is low-effort, high profitability money coming Gravity’s way.

To be clear, a license in China is phenomenal news for several reasons. China is the largest mobile market in the world at almost $60 billions in revenue, dwarfing all of SEA together (see image source data.ai). A hit in China could drastically impact Gravity’s bottom line for the better.

Moreover, the chinese market is virtually untapped by Gravity today. Ragnarok Online (the PC game) stopped services in China back in 2016. So Gravity stands to gain more than short-term cash, they have an opportunity to revive the Ragnarok franchise in China. A success would have ripple effects for future games over there. Given how it was massively successful in Taiwan and Hong Kong, we believe it is not unlikely that the game could perform in the top 10 in China.

Q4 & Beyond: Other games releases

ROO Latam: On top of China, RO: Origin will be released in Latin/South America in Q4. This is meaningful given how Ragnarok Online has a strong remaining Brazilian fanbase and community (on private servers, if you look at how many Ragnarok Online youtube videos are from Brazil, it’s surprising). We don’t think they have significant advertising capability over there to make a splash, but hopefully the community will do its work.

The Joker: Ragnarok Begins is due to go into beta testing in Q4 in South Korea. It’s a side-scrolling RPG, cross-platform. How many times is the word “nostalgia” appearing on Gravity’s strategy book ? Probably a few times. Begins has been in the works for a while as it was released November 15th 2022 in the West (consider it a beta for them), so they have had some time to polish/entirely correct the gameplay. Begins took a while to hatch, too. It was initially targeting the second half of 2021 for the West. So.. flip a coin ?

Finally Ragnarok: Returns (yep yep..) is in CBT in Korea and we hear very little about it so, it’s probably not doing great. Let’s see what they have to say about it in Q3 earnings.

The whole indie games spiel: They had 3 slides on it in Q2 earnings, so they’re serious about it.. Maybe ? Non Ragnarok games at this stage is throwing spaghetti at a hidden wall, but a good way to use some of their cash on publishing indie studio games and learn from it. Who knows, they might find a diamond.

Stock & Valuation in Q3

That’s for the ops key updates, now what’s with the stock ? Since Gravity reported their Q2-2023 on the 9th of August, the stock is actually down from $74.30 at earnings to $65.10 as of writing, a drop of 12.4%. If that is not a textbook “sell the news” situation, we don’t know what it is.

Selling the news did not surprise us, but what did is that it did not recover. We do not believe anybody expected a monster beat like that. Nor the ROO China news that came out of nowhere.

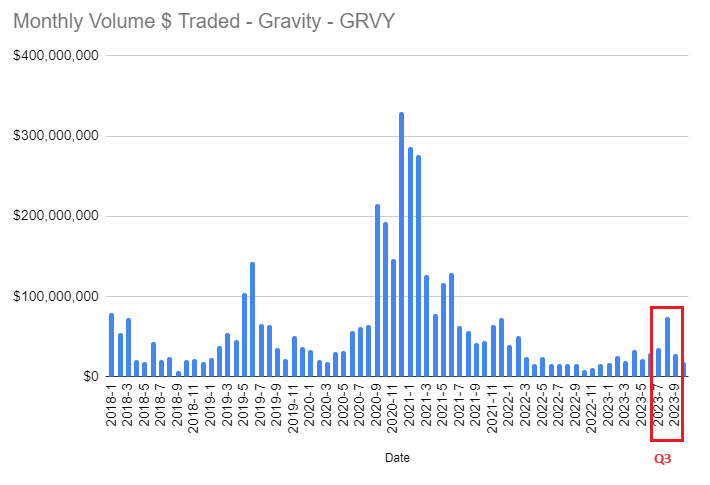

Looking at the traded volume, August was the largest month since pre 2022, at US$75 M traded. Interestingly it did not lead to any surge in price, on the contrary, there must have been some big sellers. In any case, these volumes are still massively dwarfed from the 2020-pandemic-fintwit era as shown in the graph.

So what does it mean in terms of valuation? It’s a madhouse. At time of writing, Market Cap is US$447M.

Which means, taking Q2 numbers:

- Enterprise Value = $138M

- Cash is US$309M → 69% of MktCap is in cash

- TTM Revenue: US$507M → That is 1.13x MktCap

- TTM Net profit: $US97M → EV/Net profit at 1.43.

- Profit margin is stable and averaging 19% over last 6 quarters

Find me another company in that industry with such a cheap valuation, and I’ll be more than happy to research it thoroughly. Cash-rich, vastly profitable, constant growth for 5+ years with EV closing on to 0. Good luck

So why aren’t investors getting back in? From the discussions we are seeing, these factors come up regularly:

- Cash hoarding – we mention it in every article, investors would like to see a good acquisition, a buy-back or rather dividends given 63% of market cap is cash.

- Gungho’s 59% majority ownership as a separate, publicly traded company

- Lack of trust in the new games pipeline, with ROX and ROO at the end of their 4-5 years cycle

Whilst we agree on most, it seems to us that is only looking at the glass half empty. That cash will be deployed eventually, likely towards growth and acquisitions. Given the consistent annualized growth over the last 5 years, investors’ negative opinion on the management team capability to steer the ship is ill-placed. Yes, their communication is atrocious. But it’s more likely that Gravity will keep on delivering successful games and growth than not. Even more so with their cash chest.

Conclusion: Pros & Cons going into Q3

What we don't like

- Q3 << Q2. We know it, you know it. Investors tend to overreact rather than look at annualized trends, which are looking great

- Pipeline always seems busy but really hard to assess the actual potential. ROO played into the Ragnarok Online nostalgia with grand success. Latam/China release & ROX Global will keep money flowing in the next 6-9 months. They need another hit after that.

- They simply do not care about shareholders and getting more investments, it seems. Their IR/PR game is and has been sub-zero for years. It’s like they’re not excited about their own success.. Given how Gravity is outpacing Gungho, we hope to see the cash cow take a more central place in the mothership’s strategy.

What we like

Current valuation remains massively discounted as highlighted. Even with Q3 < Q2, Gravity is already priced for abysmal decline.

With 69% of the market cap in cash as of writing, 19% average profit margin and EV/Net Income at 1.43, we are not worried about our holdings.Even if it’s gone out of the top ranks, ROO SEA started off so strong, it has the hallmark of a long tail of revenue and profitability over the next 12 months.

China’s announcement is the cherry on the icing of 3 years of a very successful campaign for Origin. Upside is huge and has long-term positive ramifications for Gravity.

As usual, do your research, ask your questions and GLTA!

Disclaimer

The information on this website is for educational and informational purposes only and should not be construed as professional investment advice. Please consult with a licensed financial advisor before making any investment decisions based on the information provided on this website. We do not endorse any particular investment product or strategy, and you should make your own decisions based on your own research, risk tolerance, and financial circumstances.