Pre-Earnings Update on Zen Game & Feiyu

Executive Summary

- Zen Game (2660.HK), one of our 4 active picks, has seen its stock value nearly doubling in January after a long wait – time to trim ?

- Feiyu (1022.HK) has seen some positive momentum in the last few months and sits now at +20% from our initial price and we are not ready to sell

Zen Game is on a roll

What seems like ages ago – in July 2022, we detected a major increase in revenue from the Chinese video game company Zen Game, which to our surprise was due to a gain in popularity of their long-lasting Mahjong game, as mentioned in our initiation article.

We knew we were doing something right, Zen Game announced another special dividend in October of HK$ 0.15/share. At the time, the share was around HK$1.50-1.60, so that’s a 9-10% special dividend straight in our pockets. Combine that with their June 2022 annual HK$0.15 dividend, that gives you a hefty 20% dividend in 2022. We will take that thank you very much!

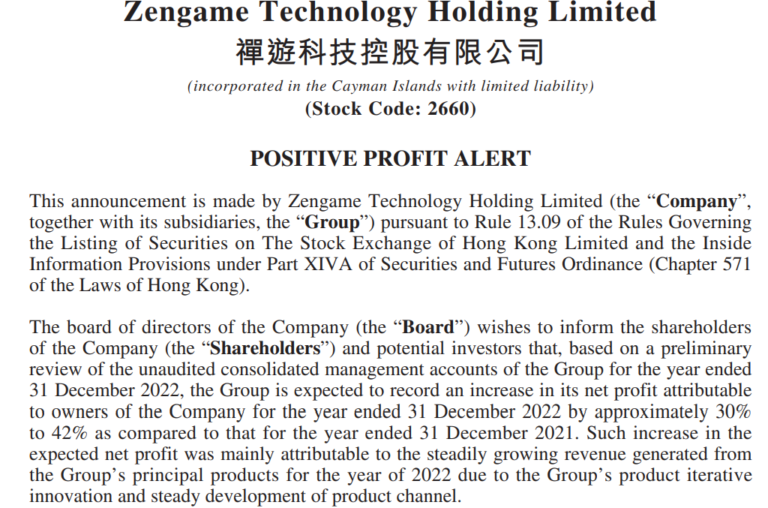

To top all of that, on January 17th, Zen Game posted a positive profit alert in their IR circulars (see image), sharing they expected their full year net profits to increase by 30% to 42% compared to last year, which gave even more wind to this hike in stock value.

Dividends were but an early sign - stock doubles!

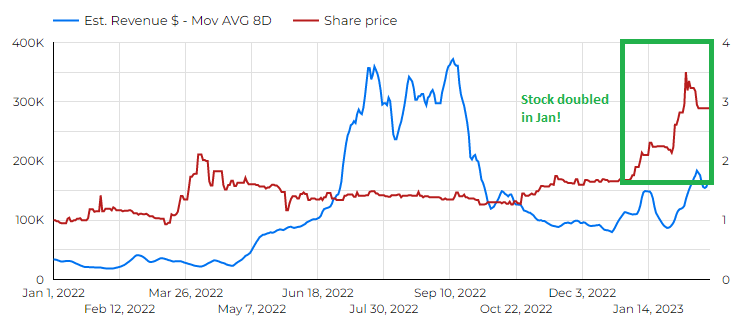

Finally, this January, something clicked and investors poured into the stock, doubling its value in just about a month! Since Zen Game only reports twice a year, and the next release is due in March, we believe some larger players crunched the numbers like we did, and started building a serious position.

You can see in blue their revenue went down after the initial June to September peak, but they are still doing well with a much higher baseline.

We hope you appreciate the Paint effort here, we are thinking about moving career towards design.

So - What's next for Zen Game ?

Honestly – Zen Game is still doing pretty well, and the stock has some wind blowing behind it, so it might have some more leg up. But we are no oracles, just data-driven investors, therefore we suggest trimming position and taking profit at the HK$3 mark it sits right now. That’s almost double since the buy decision at HK$1.54.

We are not closing the pick just yet – but we certainly will if it starts entering a down trend. With COVID-19 restrictions lifted recently in China, we think the mobile gaming pie size could reduce in the short-term, and with that Zen Game’s share of it. We will keep monitoring and update if we do close it.

Feiyu’s games are still performing

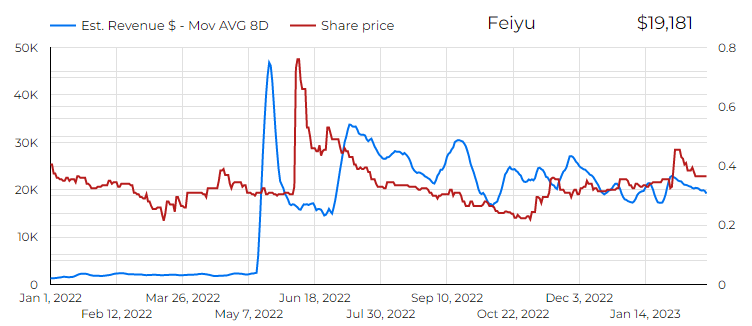

Feiyu, like Zen Game, only reports twice a year their earnings, with the next one expected end of March or April. This mean, we have had pleeenty of time to check their revenue and see how they are doing. Whilst the stock already went up by 20 since we initiated it, for a company that size (US$ 80 millions market cap), it does not mean much.

Looking at their revenue over time, using a 8-days moving average, we estimate their ongoing iphone revenue pace at approx. US$25k/day. As we often pointed out, Google Play does not exist in China. Their biggest store is the Tencent store, but they have many. We generally estimate Android revenue to be 2-3x iphone in China for our approximation. So taking 2x, that gives us 25+50 = US$ 75k/daily for Feiyu. That is close to our May 2022 estimation of US$80k daily. So we think Feiyu’s second half revenue of 2022 could be very roughtly approx. US$15M, which equals their full 2021.

And just like ZenGame, Feiyu released a profit warning on 14th of February, mentioning a 67% decrease in net loss at RMB15 to RMB25 millions vs RMB76.6 millions last year. In US$, 2.2 to 3.6M net loss vs 11M loss in 2021.

We would have loved them to turn a profit this year, but look at the above graph again. Their sudden success only kicked in at half-time. If they are able to keep this up as they seem to be doing for 6 months now, we are looking at a profitable 2023. Actually, we are pretty sure the 2H-2022 is profitable already!

You’d think such news would send the stock to new highs – but really no one seems to follow this stock, so..patience padawans. It’s not the first time we have to wait for market inefficiencies to be corrected.

So what do we do next with Feiyu ?

Clearly, Feiyu is headed towards profitability, and as far as we are concerned, that is the right direction! FY2023 has started very strongly indeed, the company’s turnaround story continues and we think the rewards higher than the risk.

That being said, Feiyu has only two games making most of their mobile revenue, which we see as a longer term risk compared to a company like Gravity. But the fact its valuation of US$80 millions, which is higher than we would like it to be given they are not profitable and will generate below US$30 millions in revenue, is why we only have a smaller position here, we see it as a riskier play.

Invest at your own risk – GLTA!