Strong Q1 from both Gravity and Aiming

Executive Summary

At the end of April, we wrote an in-depth pre-earnings update article on both Gravity (GRVY) and Aiming Inc (3911.T) to cover their operations in Q1. By monitoring their app rankings, we expected both companies to post strong quarterly results. Their earnings are out and as expected, we are making solid virtual profits to date. See for yourself!

Gravity:

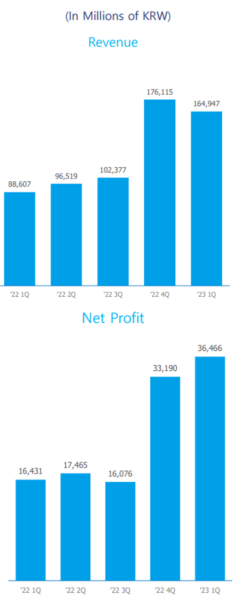

- Gravity just announced May 11th another smashing quarter as expected. Q1 2023 revenues came in at US $126M, a 6.3% decrease QoQ and 86.2% increase YoY.

- Net profit turned at US $28M, higher than we anticipated. It’s a 10% increase QoQ and a 120% increase YoY.

- Investors liked it and the stock went up 8% on earnings day. More to come ?

- With almost half of Q2 already done and the immense success of ROO released in SEA early April, Gravity is on a bender and we are loving every bit of it.

Aiming:

- Aiming 2023 Q1 revenue came in at JPY 5’158M or approx. US $38.4M, a 30.8% increase QoQ and a 54.3% increase YoY

- The company boosted profitability thanks to both continuous success of Master of Garden and lowered SG&A costs as we expected

- Investors rewarded the performance and the stock is up 24.4% since earnings

Overall, even if the macro environment is pretty grim in the mobile gaming industry, those two are clearly outperforming the market and we’re happy holders.

Interested in more details on their performance and what is to come? Read below!

Gravity Q1 Update

Q1-2023 Highlights

As expected, Ragnarok Origin (ROO) Taiwan and Ragnarok Next Generation (ROX) in South Korea drove the bulk of the revenue for this quarter, for this was all clear to see in the app rankings we monitor.

Here are some key metrics about Q1 and beyond:

- Q1 Results: Revenue of US $126M and a net profit after tax of US $28M

- Trailing-Twelve-Months (TTM) results: This puts Revenue TTM at US $406M and Net Profit TTM at US $78M

- Cash and valuation: Company has a cash balance US $287M, no debt and a company market cap just below US $400M at the time of earnings putting it’s Enterprise Value at around US $113M

- EV multiples: Company EV sits at 1.45x yearly net profit and 0.28x yearly revenue, which remains incredibly low.

With Q2 expected to be another growth quarter as Ragnarok Origin is smashing it in all of SEA – where it had 10 millions pre-registered users – we are very excited about the coming months. We detail more on this in our previous article.

What's next for Gravity's stock ?

At current valuation, Gravity is an absolute steal. At this rhythm of performance, they will have an enterprise value of 0 next year, which is mad. That is why we believe something has gotta give. Whether it’s analysts picking up the stock, buybacks, dividends, an acquisition.. We are waiting for the catalyst that could drive this stock through the roof.

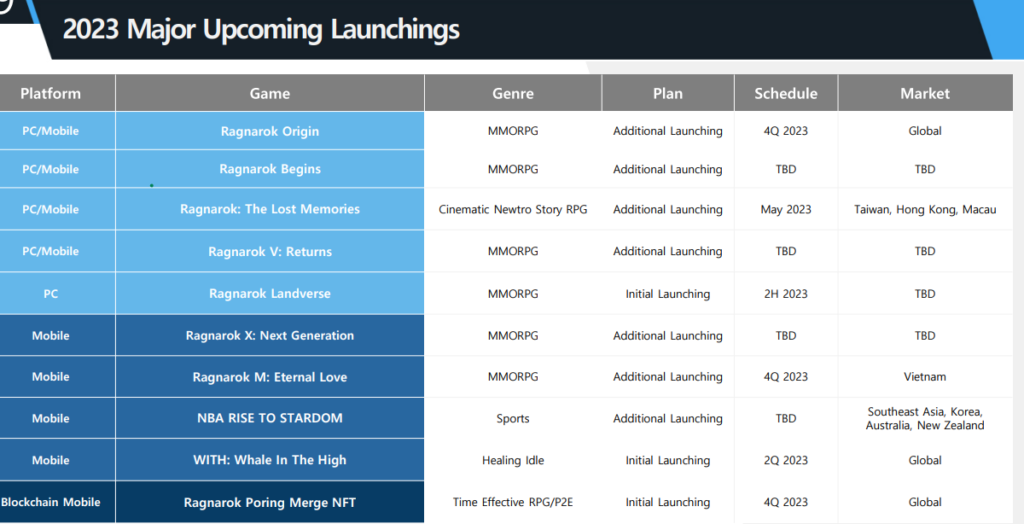

Looking at the risks, Gravity needs new “A” games (or at least one) to come out this year or next year in order to keep growing revenue long-term. They have been surfing on the successes of ROO and ROX for 3 and 2 years now.

A new hit would go a long way towards reassuring investors, and we are yet to see which of their many games in the pipeline will be that hit (see picture for pipeline).

Looking at how their Ragnarok IP is an absolute favorite in Asia, we are not too worried though.

Another growth opportunity is China, in which they (through chinese partners) have applied for both ROO and ROX licenses. We do not fancy the odds on that front, though.

All in all, we keep holding to our shares and gleefully hope that the market is finally going to reward performance

Aiming Q1 Update

Q1-2023 Highlights

we noted in our previous article that we expected profitability to be there for Aiming in Q1 thanks to a full quarter of Master of Garden successful live operations and lower user acquisitions costs. And we were quite right:

- Aiming Inc. Q1 2023 revenue came in at JPY 5’158M or approx. US $38.4M, a 30.8% increase QoQ and a 54.3% increase YoY.

- Operating income came in at US $4.3M, a 71.2% increase YoY and Net Income came in at US $1.63M, a 9.2% increase QoQ.

As a consequence, investors piled in and the stock went up 35% shortly after earnings and went back down since then, sitting at +24.4% since earnings (see the earnings arrow in the gorgeous drawing), giving it a market cap of at US $162M the current stock value of JPY 564.

What's next for Aiming ?

We believe this valuation is fair, especially as investors are weighing in the strong pipeline with 2 expected games in the near future:

- “Is it wrong to try to pick up girls in a Dungeon? Battle Chronicle” planned for May 23rd, based on the popular anime IP “Danmachi”

- “Kaminaga Shijima ~ Rinne no Miko ~” planned for June 6th for a combined game and manga release, developed and published jointly with LiTMUS Co, a subsidiary of UUUM Co (Ticker 3990 on Tokyo Exchange) and Kodansha Co

We decided to keep our Aiming stake even with the stock going up significantly since earnings. We will be monitoring closely their ongoing operations and these new releases.

Should their next releases not succeed, we will happily take our gains and move on. But for now, it’s wait and see.

Conclusion: we hold

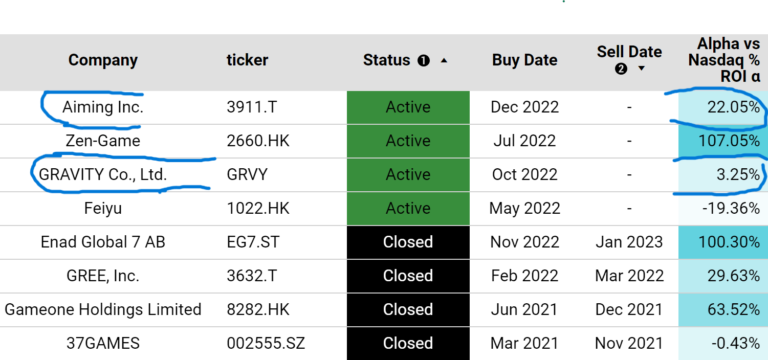

We are very happy with the operational performance of Gravity and Aiming (see our dashboard) and with the virtual profit their performance led to:

- Gravity is up 19% since we picked it in October, beating the Nasdaq by 3% in that timeframe!

- Aiming sits at +34% since we purchased its stocks in December, beating the Nasdaq by 22% in that timeframe !

As always, do your due diligence and decide for yourselves! GLTA!

Disclaimer

The information on this website is for educational and informational purposes only and should not be construed as professional investment advice. Please consult with a licensed financial advisor before making any investment decisions based on the information provided on this website. We do not endorse any particular investment product or strategy, and you should make your own decisions based on your own research, risk tolerance, and financial circumstances.